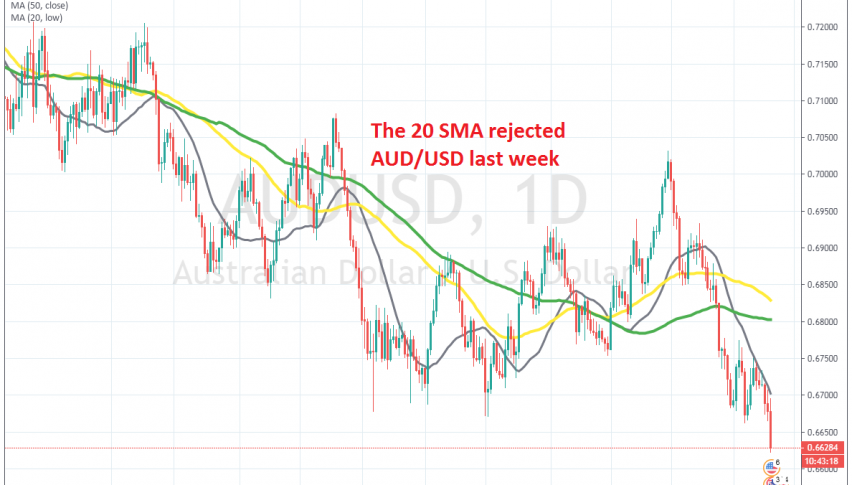

Looks Like AUD/USD is Resuming the Bigger Bearish Trend

AUD/USD retraced higher twice earlier this month, but the retrace ended at the 20 SMA and now sellers are in charge again

[[AUD/USD]] has been on a bearish trend, since summer of 2011. Although, the decline staled in August at 0.6660-70 and sellers haven’t been able to make new lows since then. In fact, after some consolidation during the last few months, we saw a decent climb in December, after the Phase One trade deal between US and China.

But, the climb ended right after 2019 ended and since then the trend has been bearish with only some minimal pullbacks higher, as shown above in the daily chart. The well known factors for this bearish momentum such as the tensions between US and Iran, as well as the coronavirus have turned the sentiment negative, which have been hurting risk currencies.

We saw a couple of retraces higher again this month, but, they ended and now the price is headed down again. The 20 SMA (grey) did a good job in providing resistance during the latest retrace higher, pushing the price lower for several days. Now, it seems as we are headed for lower lows, so we still keep a bearish bias for this pair and will try to sell retraces higher, as we did yesterday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account