Forex Signals US Session Brief, Feb 24 – Fear Returns Again in Markets, As Coronavirus Cases Increase in Italy

The coronavirus outbreak has been messing with the sentiment in financial markets, driving them up and down since mid January. There was panic in the last two days of January, as the virus turned into a pandemic in China. But, the sentiment improved earlier this month, after the pace of spread slowed in China and the cases outside of China were low. This gave us the idea that the worst was behind us and the virus was getting under control. But, over the weekend cases of infected people and deaths outside of China jumped higher, particularly in Italy and South Korea, as well as in Iran.

Now fears that the virus might turn into a global pandemic, especially in Europe after the surge in cases in Italy have gone up again and the risk sentiment has turned sour again in financial markets. Gold has surged higher, while risk assets, especially stock markets are in a bloodbath. Bond yields also cracked lower with 10-year Treasury yields falling below 1.40% while 30-year yields continued to chase fresh record lows during the session. We saw some improvement from the data today, in Canada and the Eurozone, but today’s number’s don’t take into account the coronavirus impact, so we will have to wait for the data released next month to see how big the impact is.

The European Session

- German Ifo Business Climate – The business and investor climate deteriorated in the Eurozone and particularly Germany during last year, as the trade war hurt the manufacturing sector. The German Ifo business climate indicator bottomed out in September/October and it has started to improve slightly. Today’s report showed further improvement, but the coronavirus impact is yet to be felt. Below is the report.

- Germany February Ifo business climate index 96.1 vs 95.3 expected

- Prior 95.9

- Expectations 93.4 vs 92.1 expected

- Prior 92.9

- Current assessment 98.9 vs 98.6 expected

- Prior 99.1

- Ifo Economist Wohlrabe Comments – The Ifo data beat expectations across the board as business morale improves for the month of February despite concerns surrounding the coronavirus outbreak. Ifo notes that the domestic economy does not seem to be affected by the virus situation. But, Ifo economist, Klaus Wohlrabe, thinks that the effect of the virus will be felt in the economy in the coming months.

- Development of coronavirus epidemic not yet fully reflected in our survey

- 1% less economic growth in China would shave just 0.1% off German growth

- If virus becomes a pandemic, would be particularly hit due to reliance on exports

- Industrial sector is reporting significant improvement in orders compared to 2019

- New orders have come in and domestic demand is picking up

- US Trade Secretary Speaking on US-China Relations – US Treasury secretary, Steven Mnuchin was making some remarks in an interview with Reuters earlier today, speaking about the coronavirus impact and the trade relations between US and China. Below are his main comments:

- No material impact from virus on US-China trade deal for now

- Does not expect material impact of virus outbreak on Phase One deal

- Impact on US-China trade could change as the situation develops

- A better assessment is only possible in a few weeks’ time

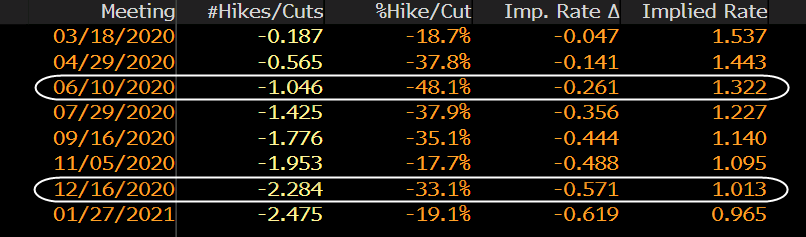

- Two More Rate Cuts from the FED in 2020? – The FED has cut interest rates three times already, during summer last year. Markets were anticipating no more cuts, or at best, just one more further towards the middle of the year. But, now after the outbreak of coronavirus, the odds of cutting rates further have gone up and narkets are anticipating 2 more cuts this year.

US Session

- Canadian Wholesale Sales – The Canadian economy has been weakening during 2019, following the rest of the globe. Certain sectors of the economy fell in contraction, while wholesale sales declined in three out of the last four months. Sales have declined by 2.5% in total since August last year. But, today’s report showed a decent jump for December.

- Canada December wholesale trade sales +0.9% vs +0.4% expected

- was -1.2% (revised to -1.1%)

- Four of seven subsectors higher

- Volumes rose 0.8%

- FED’s Bullard Not Sounding Too Dovish Now – The FED turned quite dovish last year, cutting interest rates three times, after being hawkish for several years. The global economy weakened considerably due to the trade war between US and China and the US economy was affected by it as well. So, the FED has been bearish since last summer, but it seems like they might be shifting their stance now. Bullard was speaking a while ago and his comments sounded more hawkish than dovish. He doesn’t have a vote at the FED, but his opinion matters nonetheless. Below are some of his main comments:

- Low probability that virus outbreak will get much worse

- Market expectations likely to return to “on hold” outlook

- Fed is in great shape, don’t have to lower rates

- Have been concerned by yield curve issues

- Fed purchases in repo market are not QE

- Coronavirus Update –

Country,

Other

Total CasesNew

CasesTotal

DeathsNew

DeathsTotal

RecoveredSerious,

CriticalChina 77,345 +409 2,593 +151 25,033 11,477 S. Korea 833 +231 8 +2 22 6 Diamond Princess 691 3 2 36 Italy 229 +72 7 +4 1 23 Japan 154 +8 1 23 7 Singapore 90 +1 49 7 Hong Kong 79 +5 2 12 6 Iran 61 +18 12 +4 3 Thailand 35 15 2 USA 35 5 Taiwan 30 +2 1 2 1 Australia 22 11 Malaysia 22 17 Germany 16 14 Vietnam 16 14 U.K. 13 8 U.A.E. 13 3 2 France 12 1 10 Canada 10 3 Macao 10 5 Philippines 3 1 2 India 3 3 Kuwait 3 +3

Trades in Sight

Bullish USD/JPY

- The main trend is still bullish

- The retrace higher is complete on H4 chart

- The 50 SMA is providing support right now

.png)

USD/JPY has been on a steady bullish trend since summer last year. The trend has been unfolding in waves and pushing higher, as the sentiment improved in financial markets, on prospects of the Phase One deal between US and China. As a result, USD/JPY pushed above the big round level at 110 earlier this week.The coronavirus outbreak in China had some negative impact on this pair towards the end of last month, as the JPY rallied as a safe haven. But, USD/JPY returned higher again and ended the week around 110 two weeks ago. Then, the sentiment improved further last week as the virus was being contained within China, with only a few cases abroad and this pair surged to 112.20s.

But, the coronavirus has spread outside of China now and fears spiked that it might turn into a pandemic outside of East Asia, after the jump in new cases and deaths in Italy over the weekend. Stock markets turned bearish today and USD/JPY declined as well. This pair lost around 170 pips today, but it is facing the 50 SMA now at 110.40s. Below that, you can find the previous resistance at 110.20s, which will likely turn into support now. The 110 zone also offers some support, so if there are no more explosions of new cases outside of China, I think that we will see a bullish reversal from these levels. But, we have to follow coronavirus now.

In Conclusion

The pace of the spread of Coronavirus was slowing last week, which calmed traders down. But, the jump in new cases over the weekend, especially in Italy, increased fears that the virus might turn into a pandemic in Europe as well, so the sentiment has been quite negative today and markets will likely follow the news in the following session about how coronavirus is progressing.