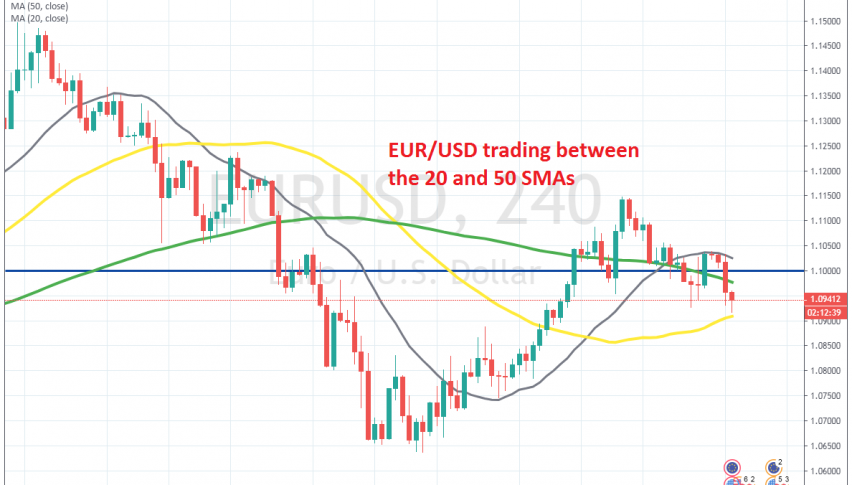

EUR/USD is Turning Lower, But it’s Facing the 50 SMA Now

The volatility has been quite high in financial markets in the last several weeks and EUR/USD has gone through a roller-coaster ride. This pair declined from 1.15 to 1.0630s as the USD surged higher, which means an almost 9 cent decline. But, the decline stopped there and last week we saw EUR/USD climb more than 6 cents higher.

This week, the decline has stopped and we are seeing this pair retrace lower. The price has slipped more than 200 pips lower from the top. Buyers tried to push higher yesterday in the US session after the pullback, but the 20 SMA (grey) turned into resistance and stopped the climb there.

Today, sellers have returned again and now EUR/USD is around 100 pips lower from the 20 SMA, so it seems like the trend is changing into bearish again now. But, sellers are facing the 50 SMA (yellow) on the H4 chart now. If the 50 SMA goes, then the downtrend will be on. We might open a sell signal if that happens, so follow our signals page for trade ideas.