Weekly Outlook, Apr 6-10: Top Six Economic Events to Watch This Week

Happy Monday, traders.

I hope you had a great weekend, and are now ready to capture more exciting trades this week. The greenback ended the week lower against the euro, the Japanese yen, and the Swiss franc as investors turned to riskier assets in the wake of worse than expected US Nonfarm Payroll figures. The data missed the economist’s forecast, and it proved to be the worst labor market data in history in the wake of the uncontrolled novel coronavirus pandemic.

COVID-19 has deadened the global markets and began to raise volatility in the forex markets. In the week ahead, we need to look at RBA Rate Decision, British GDP, US Unemployment Claims, CB Monetary Policy Meeting Accounts, and lastly, the US Inflation.

Top Six Economic Events to Watch This Week

RBA Monetary Policy Decision – Tuesday

Cash Rate At 4:30 GMT, the RBA (Reserve Bank of Australia) will be releasing the interest rate. Australian economic events are suffering over slower economic growth; especially as COVID-19 is hitting the markets badly.

On March 19, the Reserve Bank of Australia cut the cash rate from 0.50% to 0.25%, at an unscheduled emergency meeting. The RBA Governor Philip Lowe announced that the movement was directed at “defeating the economic and financial disorder emanating from the virus”. The bank is anticipated to support the cash rate at 0.25%, so traders will focus on the tone of the rating announcement.

Chances of dovish statements remain pretty high, considering the increased number of coronavirus cases around the globe, where most of the nations are increasing the lockdown period, which is increasing the chances of a further slowdown in business.

OPEC Meetings – Wednesday

The OPEC meetings are usually held twice a year to discuss the demand, supply, and pricing of crude oil. OPEC meetings are normally held in Vienna and are attended by delegates from 15 oil-rich countries.

They address a range of issues concerning energy markets and, most importantly, discuss how much crude oil each country will produce. The meetings are closed to reporters, but officials typically speak with media during the day, and a formal report covering policy changes and meeting goals is published after the meetings have ended.

OPEC and Russia have delayed a meeting to Wednesday while it was planned for Monday, OPEC officials announced on Saturday, as a dispute escalated between Moscow and Saudi Arabia over who is responsible for plunging crude oil prices. The delay occurred despite pressure from US President Donald Trump on OPEC and partners, known as OPEC+, to stabilize global oil markets urgently.

OPEC+ is focusing on an unprecedented oil production cut equal to about 10% of world supply, or 10 million barrels per day. Crude oil is getting stronger over sentiments, and we may see continued bullish bias in oil prices until the meeting is over.

UK Gross Dometic Product – Thursday

At 8:30 GMT, the Office for National Statistics is set to announce fourth-quarter GDP growth of the United Kingdom. It’s released monthly, about 40 days after the month ends.

Back in February, the GDP release came in at 0.0%, pointing to stagnation. The March estimate is a weak gain of 0.1%.

USD – Unemployment Claims – Thursday

At 12:30 GMT, the unemployment claims have been in the stratosphere in previous weeks, as COVID-19 drove much of the US market to a crushing end.

The unemployment claims surged to 6.6 million during the previous week, much greater than the forecast of 3.6. million. The forecast for this week is also tremendous, at 5.0 million, and this may keep the US dollar under pressure. No, surprises, it’s COVID-19, which is damaging the overall economic indicators.

ECB Monetary Policy Meeting Accounts – Thursday

At 11:30 GMT, the ECB is due to report meeting accounts. The ECB decided not to accompany the Federal Reserve and Bank of England during its previous policy meeting and did not cut its primary deposit rate, which is at -0.5%.

The bank also increased its asset purchase program by 120 billion euros. Traders will be keen to know the particulars of the meeting presented by the minutes.

US Inflation – Friday

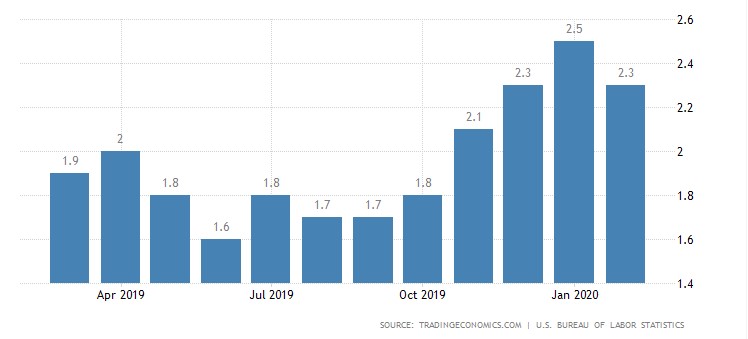

The annual inflation rate in the US lessened to 2.3% in February of 2020 from 2.5% in January, which was the most significant rate since October 2018. Numbers came mildly higher than market forecasts of 2.2%.

At 15:30 GMT, consumer inflation is expected to remain weaker in the United States. The CPI is likely to drop in the wake of the severe economic impact of the COVID-19 virus. The headline figure has come in at 0.1% for two straight months.

Good luck, traders and stay tuned to FX Leaders Economic Calendar for live market updates.