Will the 50 SMA Reverse Bitcoin Lower After the Pullback?

BITCOIN started the year on a bullish footing, gaining around 50% in value as it climbed from around $7,000 at the beginning of this year, to $10,500 by the middle of February. That came after the 6 month bearish trend in Q3 and Q4 of last year, so it looked like the trend was changing.

But, it didn’t last long; coronavirus outbreak in Italy and Europe sent shivers even through the cryptocurrency market and Bitcoin reversed down again. The decline picked up further pace earlier this month, as coronavirus spread across the globe and Bitcoin fell below $4,000.

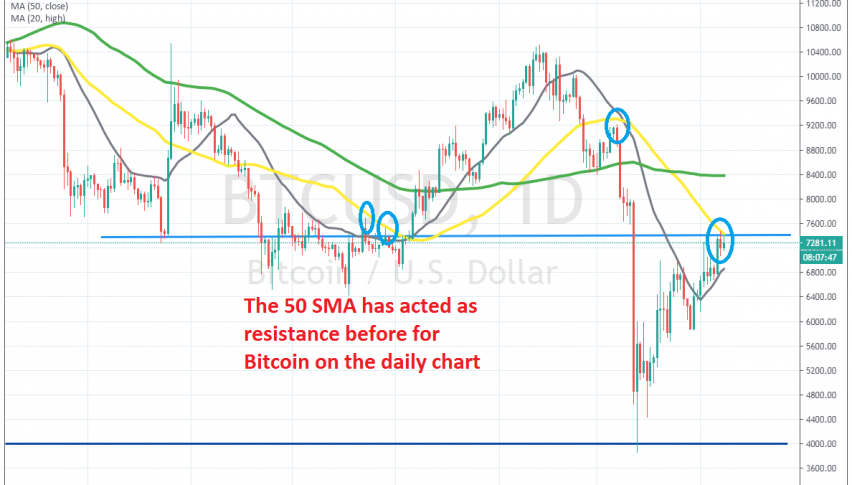

But, the decline stopped by the middle of March and since then Bitcoin has climbed higher. We don’t know whether this is a bullish reversal, or just a retrace before the next bearish move lower, but the 50 SMA (yellow) on the daily chart will make that decision.

That moving average has been acting as resistance several times before and it is doing that again now. So, if buyers fail to push above soon, they might get discouraged and sellers will come in. If they do, then Bitcoin will probably continue the uptrend to $10,000, since the world is not ending on coronavirus.