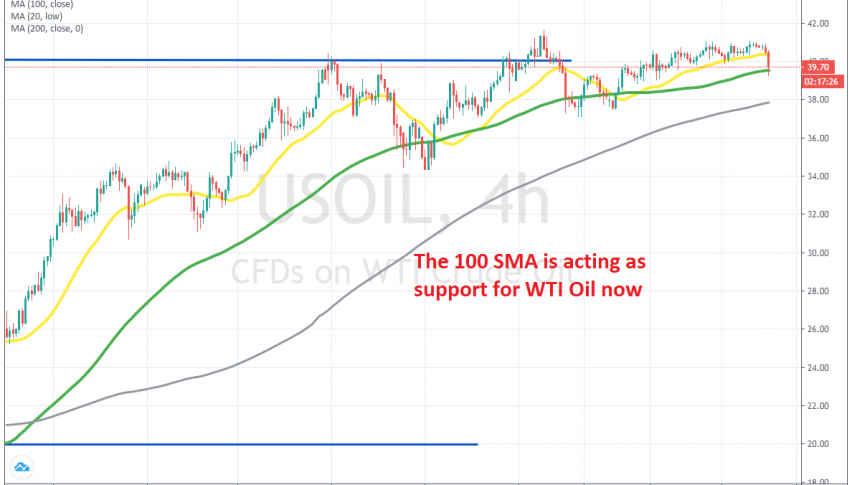

Crude Oil Facing the 100 SMA, After Slipping Below the 50 SMA

Crude Oil has been bullish since the big crash down ended by the middle of May. US WTI crude came back from the dead, after it had fallen to -$37, as Saudi’s tried to bankrupt the US Oil industry at a very difficult point in history, when people were in lock-down and other forces were trying to destroy food production and delivery chains.

But, the world didn’t end and the sentiment slowly turned positive again, especially as the lock-downs ended and the world started to reopen. So, the trend has been bullish since mid March and the moving averages have been pushing the price higher in US WTI crude Oil.

The 20 SMA (yellow) in particular has been doing a really good job in providing support for crude Oil and setting the trend on the H4 chart. But, this moving average was broken earlier today, although the 100 SMA (green) held well as support for crude Oil.

The price pierced the 100 SMA for a bit, but it has pulled back above it again now. This looks like a good opportunity to open a buy trade,since Oil has retraced nearly 200 pips lower. But, we will wait for a confirmation, probably a doji/pin candlestick, which would signal a bullish reversal. So, we’ll be following the price action for a while.