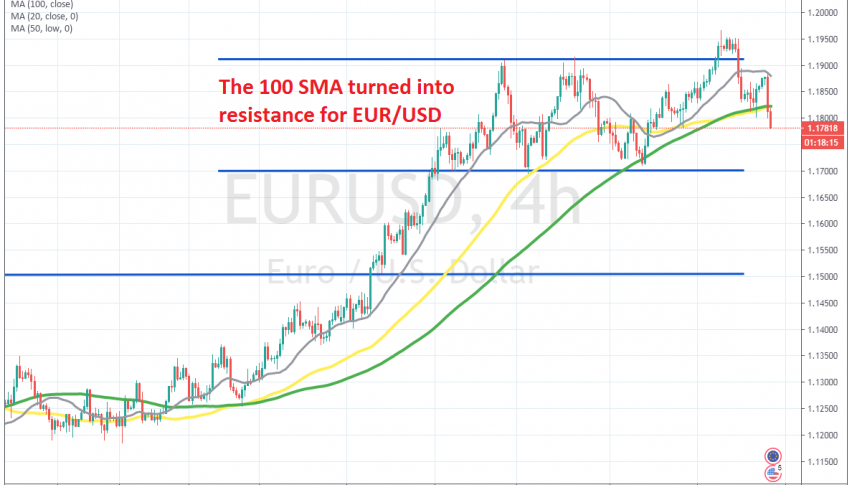

EUR/USD Uptrend Is in Danger, As It Falls Below MAs

EUR/USD has been quite bullish for several months, as the situation with the coronavirus pandemic was slightly better in Europe than in the US. Although, the decline picked up pace further in July, with EUR/USD surging from around 1.12 to above 1.19.

Buyers failed twice to break the resistance area above 1.19, but 1.17 turned into support for this pair, which has turned into the ultimate support for this pair. The bullish momentum continued this month as well and buyers pushed above the previous highs, reaching 1.1960s.

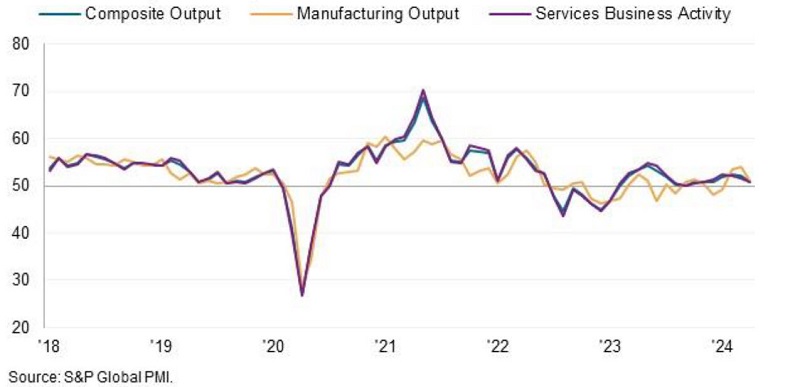

But the price reversed down yesterday, as the USD sprang back to life, although the 100 SMA held as support for the second time. The price bounced back up, but the 20 SMA (grey) turned into resistance for EUR/USD. It rejected the price and the decline picked up pace after the soft services and manufacturing reports from Europe.

Now the 100 SMA has been broken on the H4 chart, with EUR/USD heading for the support at 1.17. This sort of price action looks sort of bearish, meaning that buyers are giving up below 1.20, so I expect the long term downtrend to resume again soon in this pair. We might try to open a long term sell signal, but will see how buyers will react now. If they fail to make new highs soon, then we might short EUR/USD.