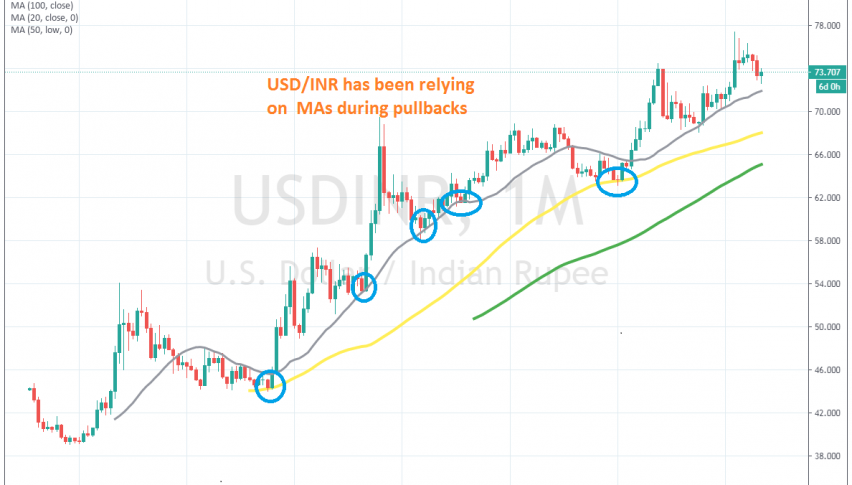

Crude Oil Tightening the Range Between MAs, Before the Breakout

The volatility in US WTI crude Oil has declined in the last week

WTI Crude Oil surged nearly $ 80 from the middle of April until the middle of June, but then the pace slowed, although the bullish momentum continued. That lasted until September 1, when we saw a bearish reversal during the first week of September, from $ 43.50 to $ 36.

But that level, which used to be a support and resistance area, provided support again earlier this month, and we saw the price bouncing off that level. US Crude Oil climbed above $ 40 again, but the 50 SMA (yellow) stopped buyers short.

The price formed a small doji candlestick below the 50 SMA, which is a reversing signal, and turned it bearish. So, the 50 SMA is acting as resistance for oil, while the 200 SMA (gray) has turned into support.

Crude oil is now stuck between these two moving averages, and it will probably break out soon, but I don’t think that it will move too much from the high at $ 43.50 and the low around $ 35-36, before the US elections, so we will try to trade this range, buying at the bottom and selling at the top.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account