US Dollar Weakens as Markets Await Large Stimulus After Elections

The US dollar is trading close to the lowest levels seen in three weeks amid rising hopes for the US to finalize a large fiscal stimulus

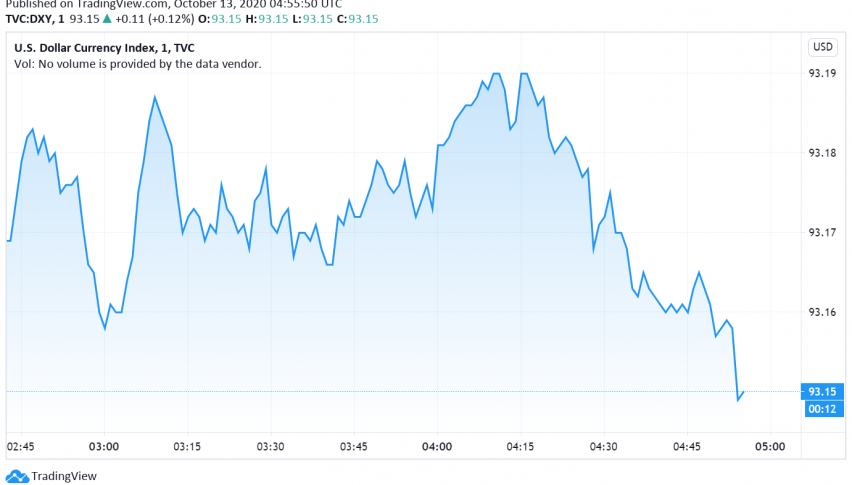

On Tuesday, the US dollar is trading close to the lowest levels seen in three weeks amid rising hopes for the US to finalize a large fiscal stimulus package soon after the upcoming elections in a few weeks. At the time of writing, the US dollar index DXY is trading around 93.15.

Even though President Donald Trump called off talks until after the November 3 elections, a huge round of stimulus to prop up the US economy seems inevitable. This has dented the demand for the US dollar and sent traders towards riskier currencies instead.

Investors are also increasingly expecting Trump to lose in the election and for Joe Biden to come to power, which is lending support to expectations for a large stimulus package that Democrats have been pushing for. Biden coming to power is expected to weaken the US dollar also because of his statements about hiking corporate tax.

The US dollar has also dipped against other safe haven currencies like the JPY and the CHF as markets continue to focus on the economic impact of the coronavirus pandemic. Meanwhile, the GBP is holding steady against the dollar as traders focus on the possibility of a Brexit deal getting finalized soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account