WTI Crude Oil Bearish on Crude Stockpile Build, Delay in OPEC+ Meeting

WTI crude oil prices continue to trade bearish into Wednesday, coming under pressure over an unexpected build-up in US crude inventories

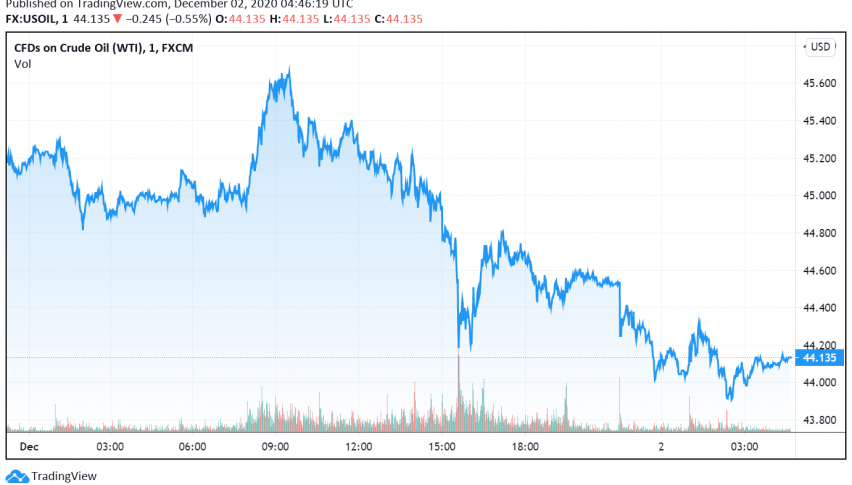

WTI crude oil prices continue to trade bearish into Wednesday, coming under pressure over an unexpected build-up in US crude inventories and worries about the outcome of the delayed meeting between OPEC and its allies. At the time of writing, [[WII]] crude oil is trading at around $44.13 per barrel.

According to the API report which released during the previous session, crude stockpiles in the US increased by 4.1 million barrels over the past week. This figure went against economists’ expectations for a drawdown of 2.4 million barrels instead, turning crude oil bearish.

As the optimism surrounding COVID-19 vaccines recede, oil traders had turned their focus towards the OPEC+ meeting scheduled for earlier this week, in hopes that the leading oil producers would extend deeper supply cuts. Especially in the wake of the second wave of the pandemic and weaker oil demand, markets widely expected OPEC and its allies to announce a three-month extension for supply cuts of up to 7.7 million bpd beyond the current deadline of December 2020.

However, OPEC+ rescheduled the meeting to discuss next year’s output policy from December 1 to December 4, delaying the decision on deeper supply cuts and raising concerns in oil markets. If the group is unable to implement more supply cuts, oil markets risk facing a glut in the face of continued weakness in demand, especially with fresh restrictions and lockdowns being announced across several parts of Europe and the US.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account