US Dollar Holds Steady – Fiscal Stimulus, Brexit Uncertainties Support

The US dollar is trading mostly steady against its major peers over the uncertainty about the coronavirus relief package, despite the

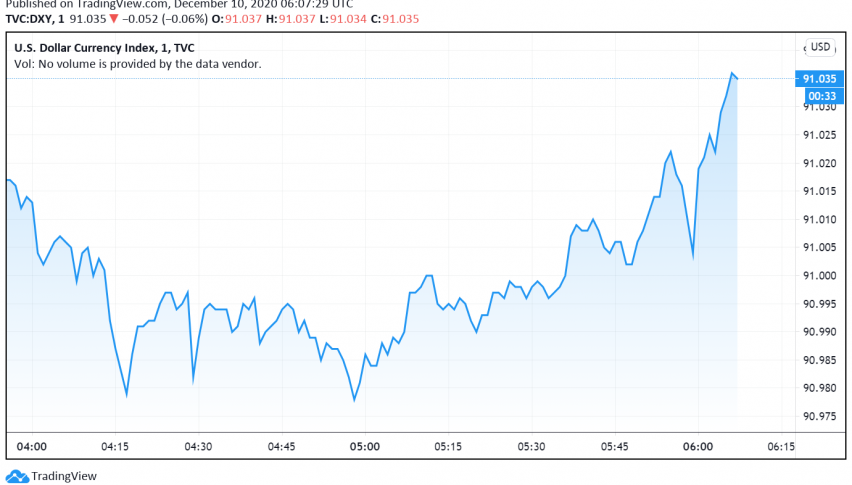

The US dollar is trading mostly steady against its major peers over the uncertainty about the coronavirus relief package, despite the prevailing risk-on sentiment in global markets. At the time of writing, the US dollar index DXY is trading around 91.03.

During the previous session, lawmakers in the US were able to approve a government funding bill but failed to reach an agreement on aid to state and local governments, prolonging the wait for the coronavirus relief package. The issue of providing legal immunity for businesses is also keeping Congress leaders from approving the next round of fiscal stimulus measures, keeping the US dollar strong for now.

The US dollar is also enjoying some support from a weakness in the Euro ahead of the ECB meeting due later today. Markets are widely anticipating that the ECB could unveil more stimulus measures in the wake of the latest wave of the pandemic, causing the common currency to trade bearish against other currencies.

Meanwhile, uncertainty about the post-Brexit trade deal has driven the GBP lower after the meeting between UK PM Boris Johnson and European Commission President Ursula von der Leyen failed to sort out differences between the two sides. Although both leaders agreed that time is running out to finalize the deal, negotiations over dinner were unable to close the “very large gaps” and talks are set to continue.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account