DOW Futures Choppy As Georgia Runoff Unfolds

The lead financial story of the day facing the DOW and U.S. equities is a political one. In the state of Georgia, Senate runoff races are being held between Loeffler/Warnock and Perdue/Ossoff. Thus far, huge turnouts are making headlines with more than 2 million mail-in ballots supposedly already cast. If nothing else, the Georgia runoffs are looking a lot like November’s General Election.

Over at Predictit.org, the Republicans are slight favorites over Democrats to maintain a Senatorial majority. Prices of Republican shares are priced at $0.58, a 15 cent premium over Democrats at $0.43. However, Democrat challenger Raphael Warnock ($0.59) is being priced as a substantial favorite over incumbent Kelly Loeffler ($0.42). At this point, the most likely scenario is for the Republicans and Democrats to split Georgia.

Midway through the Wall Street trading day, stocks are noncommittal. The DJIA DOW (+90), S&P 500 SPX (+10), and NASDAQ (+45) are hovering near flat after reversing early losses. As we move toward the Georgia polls closing later this evening, be on the lookout for heightened forex, futures, and after-hours DOW 30 volatility.

Let’s take a look at where March E-mini DOW futures stand and where they may be headed in the next 72 hours.

March E-mini DOW Futures Quiet Ahead Of Election Returns

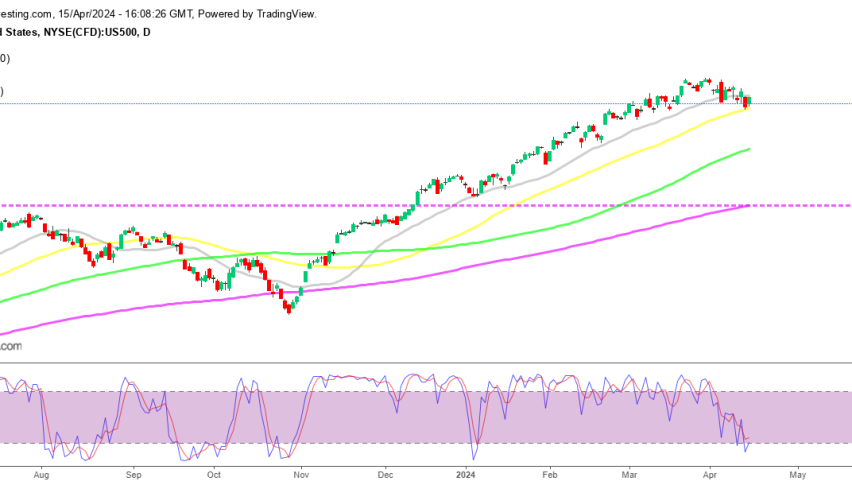

While the uptrend in the March E-mini DOW is intact, it’s showing signs of fatigue. Given today’s degree of political uncertainty, it will come as no surprise if this market posts a major short-term retracement.

++29_2020+-+1_2021.jpg)

Here are the key levels to watch as this week unfolds:

- Resistance(1): All-Time High, 30691

- Support(1): 38% Weekly Retracement, 28850

Bottom Line: If we see a major political surprise in the coming 72 hours a test of the 38% Weekly Retracement is likely. Should this scenario come to pass, a buying opportunity may set up from 28,925.

As long as 30691 is the high point of this market, I’ll have buy orders in the queue from 28,929. With an initial stop loss at 28,749, this trade yields 180 ticks on a standard 1:1 risk vs reward ratio.