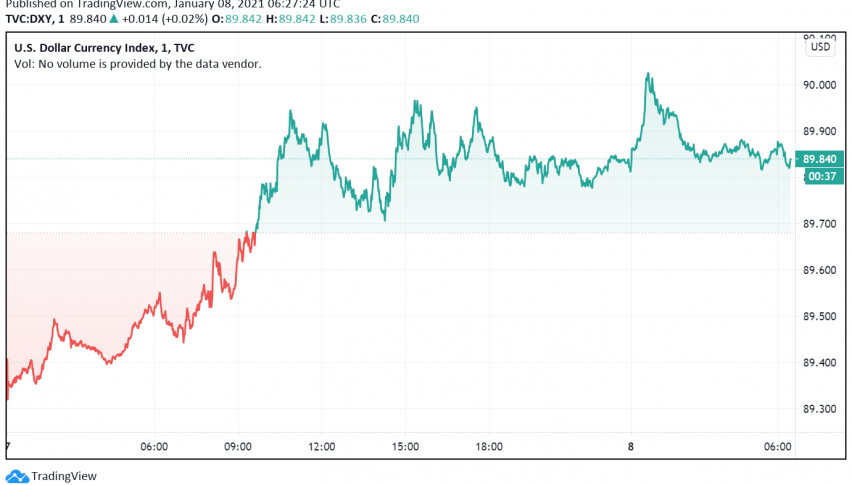

The US dollar is trading close to the highest level seen in over two months early on Friday, boosted by a rise in US Treasury yields which helped reverse some of the recent bearishness in the reserve currency. At the time of writing, the US dollar index DXY is trading around 89.84.

Rising expectations for more fiscal stimulus for the US economy had caused the dollar index to lose as much as 7% of its value in 2020 and weaken by nearly 1% since the beginning of 2021. The Democrat victory in the US presidential election strengthened hopes for a larger stimulus package to offset the damage caused by the coronavirus pandemic on the US economy.

On Wednesday, Democrats sealed a decisive majority in the US Senate after winning both seats in the Georgia elections – a move that further raises the likelihood of more fiscal spending. Analysts anticipate this sentiment to weigh on the US dollar as well as on bonds in the near future.

However, the surge in the 10-year Treasury yields above 1% has helped stem the slide in the US dollar for now. Later today, the greenback could experience some volatility on the release of the non-farm payrolls data, which could shed light on the state of the economy and offer clarity on how much more stimulus it may need.