The FED Must Be Taking Notice, As Inflation Picks Up Again in the US Toward the End of 2020

CPI inflation posts another decent increase in December

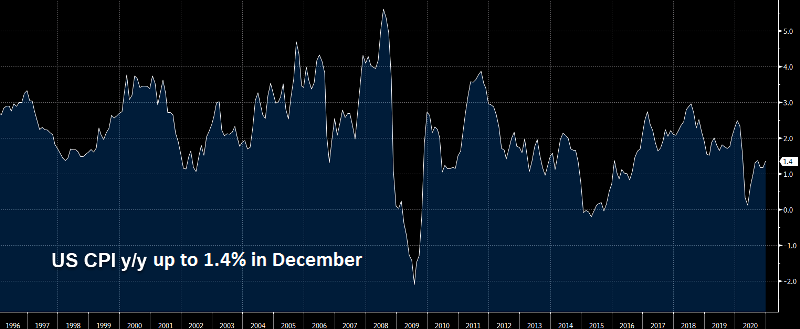

Inflation took a deep dive in the first several months of 2020 in the US, as crude Oil prices tumbled lower, slashing down prices for goods and services. Although, it held its head above water at 0.1% in April/May, while in other regions inflation turned negative. In the Eurozone inflation softened further in the last few months, falling to -0.3% since September. The US CPI inflation softened a bit as well, but it picked up again in November and today’s December data is showing another increase.

Inflation is keeping a positive trend and after the stimulus packages form the government and the FED, it should pick up further in the coming months, which would force the FED to evaluate the monetary policy, as the recent comments have shown. So, once the sentiment changes, the USD will turn quite bullish, given that everything remains stable politically and socially in the US.

December US Inflation Report

- US December CPI YoY +1.4% vs +1.3% expected

- November CPI YoY was +1.2%

- Core CPI YoY ex-food and energy 1.6% vs +1.6% expected

- CPI MoM +0.4% vs +0.4% expected

- Prior CPI MoM was +0.2%

- CPI MoM ex-food and energy +0.1% vs +0.1% expected

- Prior core CPI MoM ex-food and energy was +0.2%

- Real avg hourly earnings YoY +3.7% vs +3.2% prior

- Real avg weekly earnings YoY +4.9% vs +4.7% prior

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account