WTI Crude Oil Trades Weak – Risk-off Mood Weighs on Markets

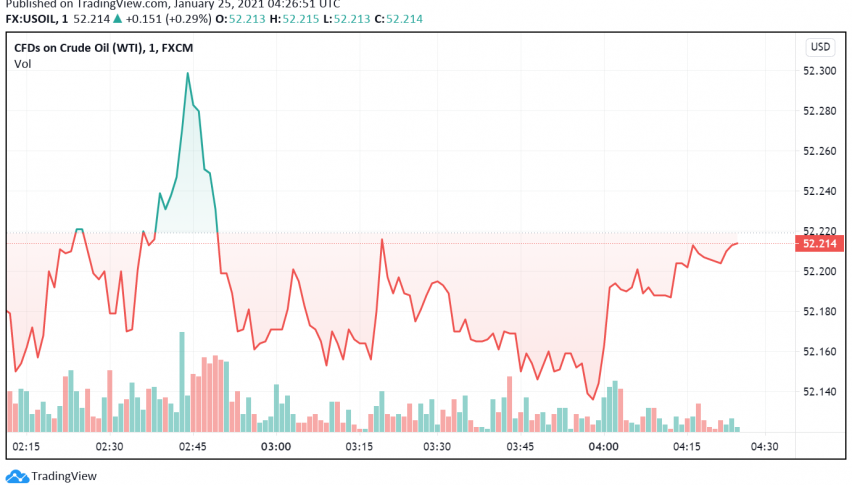

Early on Monday, WTI crude oil continues its bearish run from the previous session amid rising fears that the latest spike in coronavirus cases and resulting lockdowns being imposed by governments around the world could weaken oil demand all over again. At the time of writing, WTI crude oil is trading at around $52.21 per barrel.

Several parts of Europe have announced tighter restrictions ever since the UK discovered more virulent strains of coronavirus. In addition, more recently, some regions in China as well as Hong Kong and France have also implemented lockdown measures to curb the spread of the virus.

Fresh lockdowns hurt economic activity and send the demand for oil lower, among businesses as well as consumers. The risk-off sentiment in financial markets over rising concerns about the ongoing coronavirus pandemic and the further damage it can cause to the global economy is also keeping crude oil prices under pressure for now.

Recent data from the US is also weighing on oil markets, after the EIA reported a surprising build in crude inventories even as the number of oil and gas rigs operational in the US increased for the ninth consecutive week. Even though oil prices had received some support from Saudi Arabia’s decision to cut supply by an additional 1 million bpd, more lockdowns and restrictions will only serve to dent oil demand further, preventing the oil producing leader’s move from balancing the markets effectively.