US Dollar Weakens in Anticipation of Fed Chair Powell’s Comments

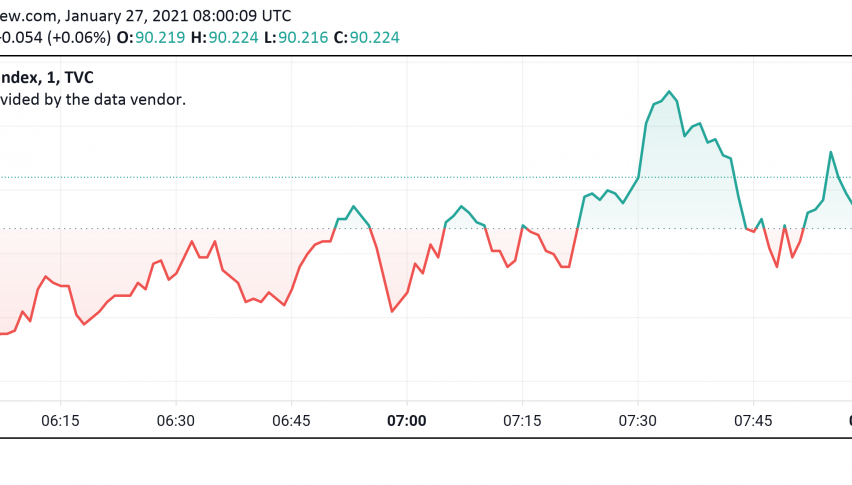

Early on Wednesday, the US dollar is trading somewhat bearish as markets cautiously wait to hear from Fed chairman Jerome Powell later today at the end of the central bank’s policy meeting. At the time of writing, the US dollar index DXY is trading around 90.22.

Traders are worried that Powell could reiterate the Fed’s commitment to keeping the monetary policy loose for an extended period of time to support economic recovery in the US after the pandemic. Expectations for more dovishness from the Fed are exerting downward pressure on the US dollar.

Additional weakness in the greenback was driven by the IMF’s latest projections for global economic growth. The IMF has turned more optimistic and revised estimates for global GDP higher as COVID-19 vaccine rollout and distribution gather steam around the world, even as stimulus efforts unleashed by governments and central banks support economic recovery.

Meanwhile, US Treasury yields posted a decline in overnight trading during the previous session, driving the US dollar lower as well. The decline was a result of an increased possibility that Biden’s latest stimulus proposal worth $1.9 trillion may be downsized and even delayed.