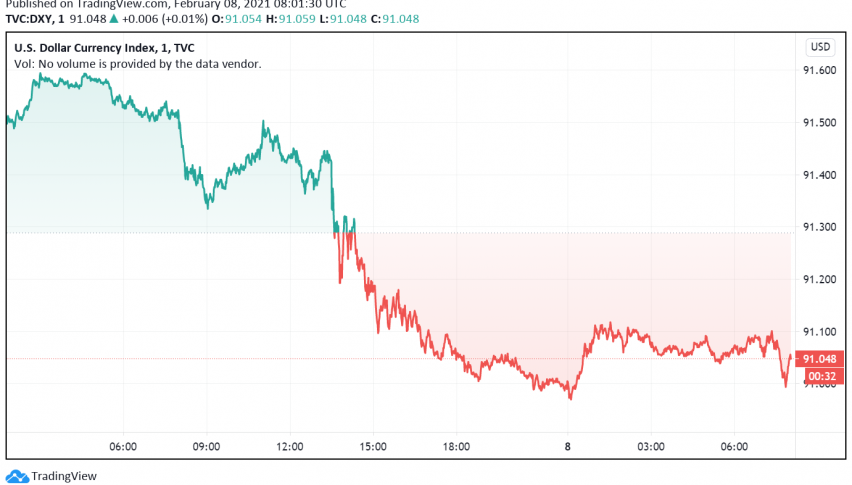

Weak Employment Report Sends US Dollar Lower Against Major Rivals

The US dollar is trading bearish against its major rivals at the beginning of a fresh trading week on the back of a weaker than expected

The US dollar is trading bearish against its major rivals at the beginning of a fresh trading week on the back of a weaker than expected employment report which released last Friday. At the time of writing, the US dollar index DXY is trading around 91.04.

Over the past few weeks, the dollar had regained some of its strength on the hopes of strong economic data from the US, which raised hopes of speedier economic recovery. However, a weak jobs report showing an addition of only 49k new jobs during January against expectations of a 50k increase has dented investor confidence in the US economy and currency.

Even as some investors have reduced their short positions on the greenback, analysts maintain that bullishness in the reserve currency would require more positive economic figures and better control of the pandemic by US authorities. Despite the vaccine rollout picking up pace, the US remains the worst affected nation in the world with the maximum number of cases.

Later this week, traders are likely to focus on more economic data coming out that can give a direction to the movement in the US dollar going forward. On the agenda are the release of CPI and consumer sentiment figures from the US – both key data points that can shed light on the state of the economy.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account