Daily Brief, Feb 12 – Everything You Need to Know About Gold on Friday!

On Thursday, the US stocks were ending higher, with Dow Jones Futures up by 0.2%, S&P 500 Futures up by 0.3%, and NASDAQ Futures up by 0.4% on the day. All three main indexes of Wall Street were on track to post gains for the second consecutive week. Early on Thursday, Federal Reserve Chair Jerome Powell said that the US Job market was a long way from a full recovery, and he called on both lawmakers and the private sector to support workers. In a speech to the Economic Club of New York, Powell noted that last month’s employment levels were nearly 10 million below February’s. Powell stressed that to achieve and sustain maximum employment, more than a supportive monetary policy will be needed.

In short, he stated that accommodative policies by Central Banks still needed to stay in place for a considerable time, as employment goals were a long way from where they needed to be. Powell’s remarks echoed the urgency voiced by President Joe Biden regarding his $ 1.9 trillion package for additional pandemic relief, that was moving ahead in Congress, despite Republican opposition.

The Fed chair repeated many times that monetary policy would remain very supportive of the economy. Meanwhile, he also cited a need for continued fiscal policy support, to bring the economy back on track. These comments by the Federal Reserve chairman added strength to the US dollar and the market risk sentiment, and weighed heavily on the GOLD prices.

On the other hand, at 00:00 GMT, the Federal Budget Balance for January came in at -162.2B, against the expected -152.4B, supporting the US dollar and adding further to the losses in the yellow metal prices. At 18:30 GMT, the Unemployment Claims for last week were released, showing a rise to 793K, against the expected 755K, which weighed on the US dollar and capped any further downside momentum in the GOLD prices. At 20:00 GMT, the Mortgage Delinquencies for the quarter came in at 6.73%.

Another reason behind the strength of the US dollar on Thursday was the latest announcement by US President Joe Biden, who said that the US had signed a contract for 100 million more doses of the Pfizer vaccine and 100 million more of the Moderna vaccine. He said that 200 million more doses of the vaccines were on their way, as the country would otherwise run-out of coronavirus vaccine doses by the end of August.

Biden added that Mr. Trump had not ordered enough vaccines, and with the high demand for vaccines and relatively low supply, the country was in danger of running out of vaccine doses by the end of August. So, new contracts for 200 million more doses have set the US on track to receive 300 million doses by the end of July. This optimistic news added to the risk sentiment in the market and supported the local currency, which ultimately had a negative impact on the yellow metal prices.

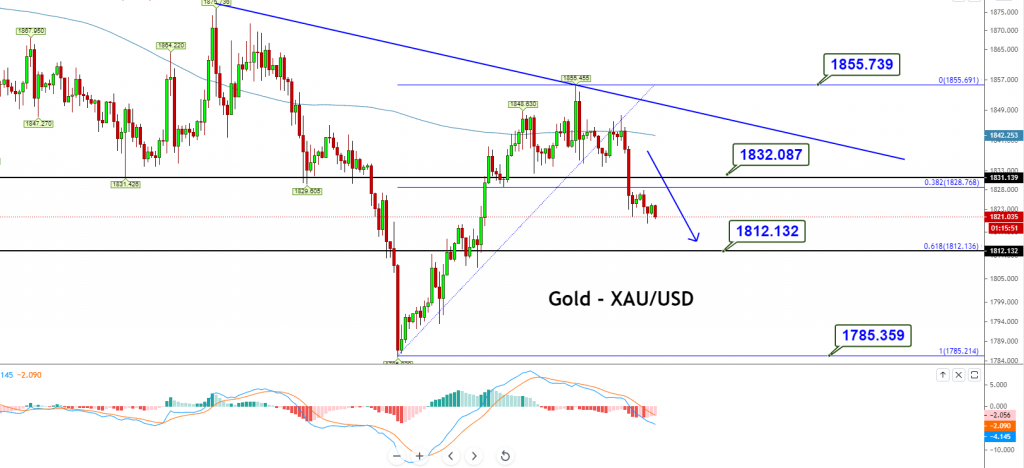

Support Resistance

1,832.26 1,854.86

1,821.83 1,867.03

1,809.66 1,877.46

Pivot Point: 1,844.43The GOLD prices fell sharply during the Asian session, to trade at 1,819, completing a 50% Fibonacci retracement level until the 1,819 mark. For now, the price is bouncing off, to trade at the 1,823 level, and it may find resistance at 1,827 and 1,833. A bearish breakout at 1,819 could extend the selling trend until the next support area of 1,811 today. A bearish bias dominates. Good luck!

Really perfect gold chart. Thank u