Gold Prices Weaken as US Treasury Yields Rise to Highest Level Since March

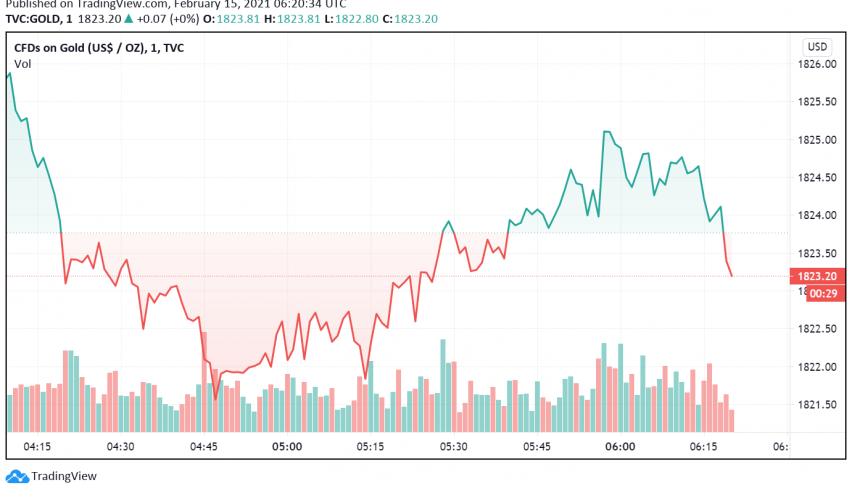

Gold prices are on the decline in early trading on Monday, weakening as US Treasury yields rose to the highest levels seen since March and denting the safe haven appeal of the precious metal. At the time of writing, GOLD is trading at a little above $1,823.

On Friday, the benchmark US Treasury yields soared to an almost 11-month high even as inflation expectations rose to the highest level seen in six years. A pick-up in inflation supports the safe haven metal but also sends treasury yields higher, which in turn increase the opportunity cost of holding gold.

The yellow metal’s prices also weakened after recent data showed a decline in the demand for the precious metal among Indian consumers during the past week. High volatility in prices kept demand under pressure in India, the world’s second largest consumer of physical gold.

Meanwhile, losses in gold remain limited as markets await President Biden’s proposed stimulus package to be rolled out soon. Late last week, Biden appealed to local officials from both parties to help approve his proposal for more fiscal stimulus measures worth $1.9 trillion.