Gold Dips as US Treasury Yields Rise, Weak Dollar Limits Losses

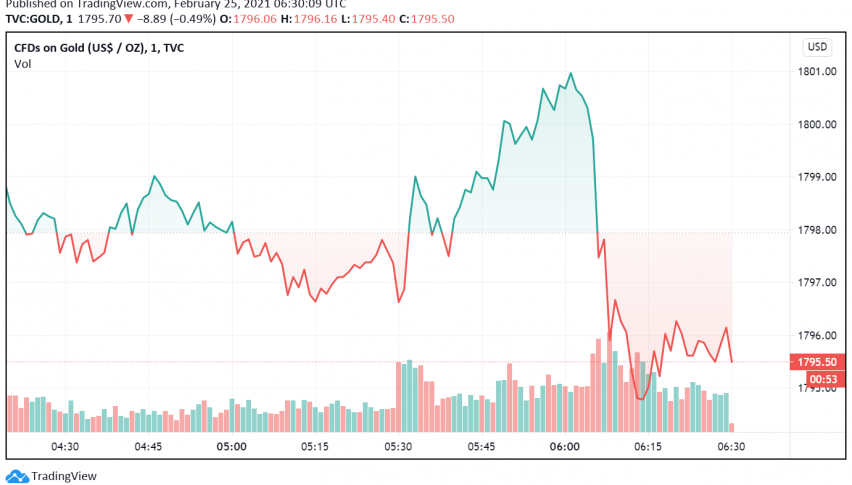

Gold is trading bearish early on Thursday on the back of a strengthening in US Treasury yields, which reduce the appeal of non-yielding bullion among investors. However, losses remain limited as the precious metal enjoys support from Fed chair Powell’s recent comments which have driven the US dollar lower. At the time of writing, GOLD is trading at a little above $1,795.

In the previous session, US Treasury yields rose to an almost one-year high even as the US dollar continued to weaken against other riskier currencies. While rising treasury yields are weakening the appeal of gold, the downtrend remains weak on account of the bearishness in the greenback, which shares a negative correlation with the safe haven metal.

On his second day testifying before the Senate Banking Committee, Powell held on to the Fed’s view of low interest rates and monetary easing until employment and inflation rebound and help revive the US economy in the aftermath of the coronavirus pandemic. Powell also played down fears of a pick-up in inflation, stating that it would only turn worrying if prices witnessed a persistent surge.

Gold has also come under pressure over promising reports about the effectiveness of the Pfizer/BioNTech COVID-19 vaccine. According to a recent independent review, the vaccine has shown to be highly effective in preventing COVID-19, which further boosts optimism in markets that the rollout of the vaccine can bring an end to lockdowns and restrictions, and send the global economy towards recovery.