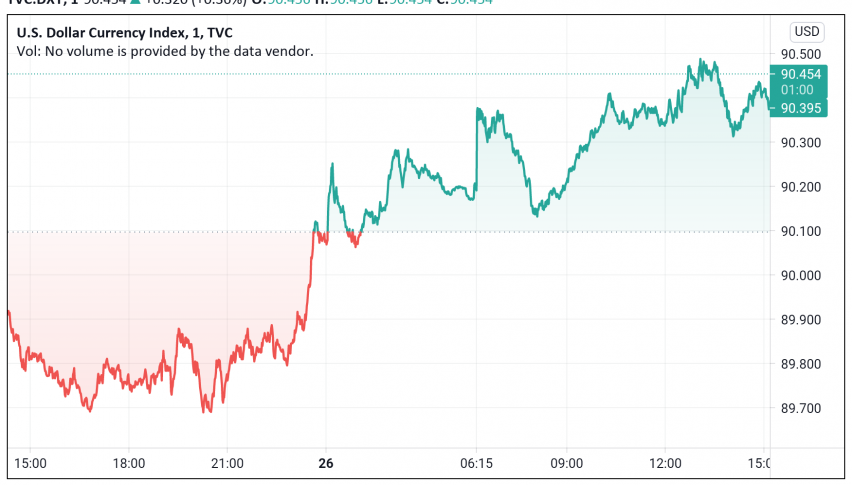

US Dollar Rebounds as Rising Yields Heighten Inflation Worries

The US dollar is trading strong early on Friday, holding on to some of its gains after bouncing off the lowest level seen in three years

The US dollar is trading strong early on Friday, holding on to some of its gains after bouncing off the lowest level seen in three years, supported by an uptick in US Treasury yields and a sell-off in stocks that boosted the reserve currency’s safe haven appeal. At the time of writing, the US dollar index DXY is trading around 90.45.

Global market have recently turned their attention towards government bonds, especially US Treasuries, in anticipation of economic recovery driving leading central banks worldwide to tighten their monetary policies. This increased interest has sent the benchmark 10-year US Treasury yields to a one-year high, helping the greenback gain back some of its strength as well.

Additional bullishness in the US dollar came from the rising yields driving investors away from riskier assets, including equities, emerging market and commodity currencies and even cryptocurrencies. The risk-off mood was triggered by escalating concerns about the impact of stronger bond yields on inflation, sending safe haven currencies like the dollar and the Japanese yen higher.

The AUD has slid lower after touching the 0.80 level against the US dollar – a two year high, while the CAD has dipped after touching a three-year high. Meanwhile, the recent weakness in the greenback had also sent the Euro to trade at a seven-week high earlier this week.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account