Employment Surges in March, Catching Up With the Rest of the US Economy

The US economy is officially back on track and steaming ahead across all sectors. Manufacturing was the first to bounce back, since it was less affected by the coronavirus restrictions. ISM Manufacturing surged to the highest level since 1983 last month, as yesterday’s report showed.

Services also caught up, surging above 60 points recently, which is a great level. Employment was lagging, with unemployment claims still in the 700K-800K region. But, today’s non-farm employment report for March was great.

New jobs surged by nearly a million, while the number for April was revised higher as well. The unemployment rate declined by 2 points, while participation rate ticked a point higher, which makes it even better. So, everything is back on track in the US.

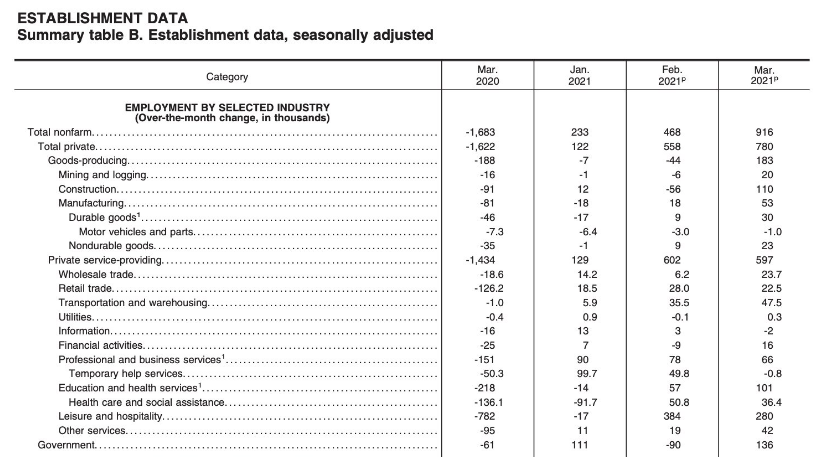

March 2021 Non-Farm Payrolls Highlights

- March non-farm payrolls +916K vs +660K expected

- February non-farm payrolls were 379K

- Unemployment rate 6.0% vs 6.0% expected

- Prior unemployment rate 6.2%

- Participation rate 61.5% vs 61.5% expected (was 62.8% pre-pandemic)

- Prior participation rate 61.4%

- Underemployment rate 10.7% vs 11.1% prior

- Average hourly earnings -0.1% m/m vs +0.1% expected

- Average hourly earnings +4.2% y/y vs +4.5% expected

- Average weekly hours 34.9 vs 34.7 expected

- Two month net revision +156K

- Change in private payrolls +780K vs +643K expected

- Change in manufacturing payrolls +53K vs +35K expected

- Long-term unemployed at 4.2m vs 4.1m prior

- The employment-population ratio, at 57.8% vs 57.6% prior

- Full report