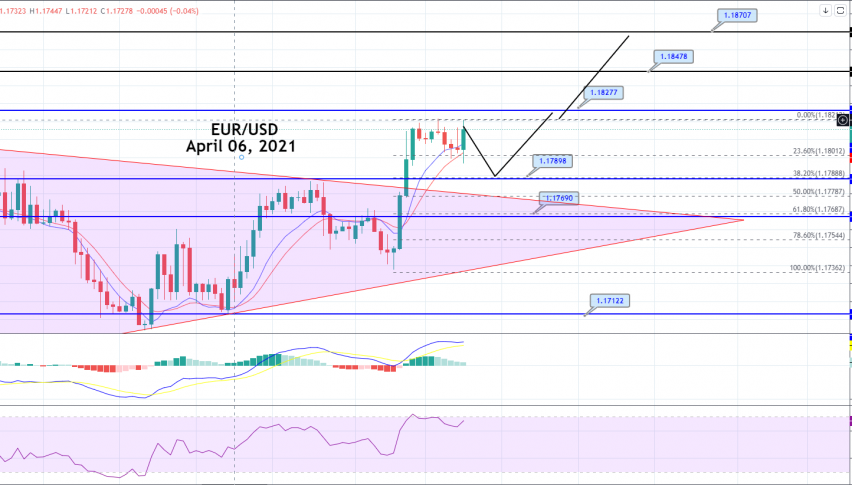

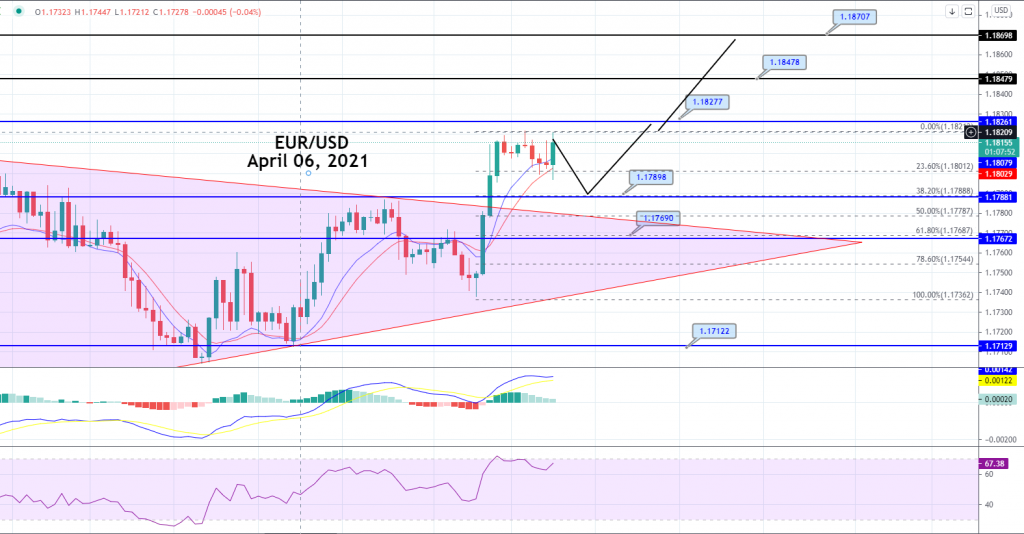

EUR/USD Violates Symmetrical Triangle Pattern – Brace for Buy Signal!

The EUR/USD pair closed at 1.18125 after placing a high of 1.18196 and a low of 1.17382. The US dollar slipped on Monday against its rivals

The EUR/USD pair closed at 1.18125 after placing a high of 1.18196 and a low of 1.17382. The US dollar slipped on Monday against its rival currencies, driven by the decline in US bond yields. The US Treasury prices edged higher on Monday and pushed the yields lower as investors paused recent selling of government bonds and took profits from short positions though the uptrend in rates remained intact after the positive NFP report on Friday.

Most of Europe was still on Easter Holiday, and the markets were closed there, so the trading volume remained limited as China, Hong Kong, and Australia were also closed. The spread between 2-year US Treasury yield and 10-year Treasury yield rose to 154 basis points that steepened the US yield curve, becoming a barometer of risk sentiment in the bond market. The declining yields also weighed on the US dollar and helped EUR/USD to post gains on Monday. The US Dollar Index that measures the greenback’s value against the major six currencies turned south and lost about 0.46% to reach 92.58.

On the data front, from the US side, at 18:45 GMT, the Final Services PMI remained flat at 60.4 against the expected 60.3 and supported the US dollar that capped further upside in the EUR/USD pair. At 19:00 GMT, the ISM Services PMI surged to 63.7 in March against the predicted 58.3 and supported the US dollar that limited the upward trend in the pair. The Factory Orders from the US dropped to -0.8% against the estimated -0.5% and weighed on the US dollar.

On the other hand, Europe struggled in its battle with the coronavirus and was acting as a host of the highly contagious mutation of COVID-19. According to data, up to 75% of coronavirus cases in the European continent were of the more contagious mutation on the virus originated in the UK.On March 31st, France entered its third nationwide lockdown after cases started to increase in the country, which President Emmanuel Macron said was due to the spread of a more contagious UK strain of the virus. However, these negative developments surrounding the virus could not reverse the EUR/USD pair’s bullish trend on Monday.

Support Resistance

1.1760 1.1842

1.1707 1.1873

1.1677 1.1925

Pivot Point: 1.1790The EUR/USD pair is trading with a bearish bias at 1.1817 level, having crossed over the 50 periods EMA resistance area of 1.1801 level. Closing of candles above 1.1789 level can drive buying trend until 1.1827 and 1.1847 level. On the higher side, the EUR/USD pair is likely to face resistance at 1.1827, but as soon as it violates this resistance mark, we may get an opportunity to go long for 1.1847 and 1.1870 level. The RSI and MACD indicators are suggesting buying trends today. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account