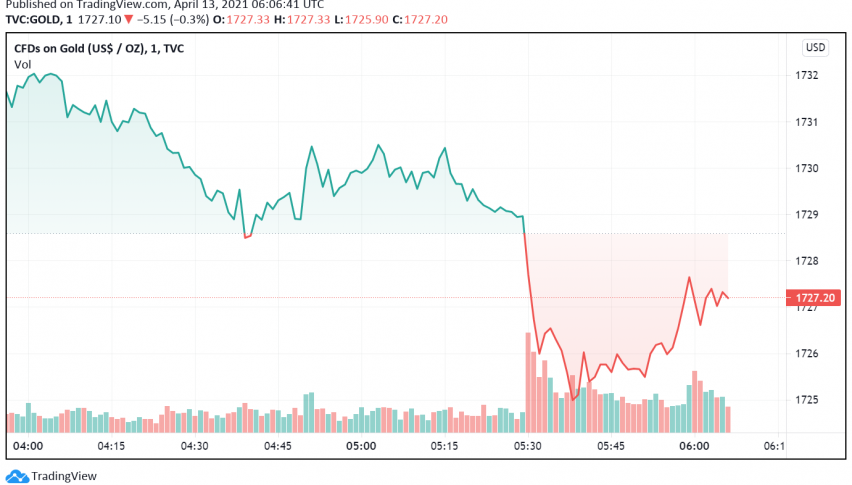

Gold Dips Ahead of US CPI Release – Treasury Yields on the Rise

Gold is trading bearish on Tuesday as US Treasury yields remain strong even as rising optimism about economic recovery keep the safe haven appeal of the metal under pressure. At the time of writing, GOLD is trading at a little above $1,727.

A successful auction of the three-year US Treasury notes have helped bond yields edge higher even as markets await more economic data releases from the US for driving more moves. As we know, higher bond yields increase the opportunity cost of holding non-yielding bullion and reduce its appeal as an investment.

All eyes now turn to the release of the CPI data from the US scheduled for later in the day. It can drive significant volatility in markets as a higher than forecast reading will once again increase concerns among traders about a spike in inflation as the US economy recovers from the coronavirus crisis, which in turn could propel US Treasury yields higher and keep gold prices under pressure.

A recent survey by the Fed also points to US consumers anticipating a pick-up in inflation during the month of March, on the back of gradual increases in prices over the past few months. Optimism about employment conditions are also likely to have boosted prices and supported an uptick in inflation.

Meanwhile, the yellow metal has also turned bearish following comments from Boston Fed President Eric Rosenberg who expressed hopes for a significant turnaround in economic conditions this year, powered by the central bank’s monetary easing and the government’s fiscal support. However, he cautioned that the labor market has a long way to go to reach pre-pandemic levels.