Gold Price Prediction: Sideways Trading Range, Quick Update on Buy Signal!

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

Today in the Asian trading session, the yellow metal extended its overnight winning streak. It took some additional bids well above the $1,780 level as the coronavirus (COVID-19) resurgence in Europe, India, and some other Asian countries like the Philippines hiked concerns about the economic recovery, which keeps the market trading sentiment under pressure and contributes to the gains in gold. Also favoring the GOLD prices could be the US-China and the Washington-Kremlin tussles, which are not showing any sign of slowing down but are getting worse day by day.

This, in turn, increased the safe haven metal’s demand. Meanwhile, the latest challenges to U.S. President Joe Biden’s infrastructure spending plan also played a significant role in undermining the market trading sentiment. Besides this, the buying bias around gold could also be attributed to the fresh reports suggesting that the Dragon Nation recently eased restrictions for banks importing the yellow metal after multiple months of slow buying. In the meantime, India’s record bullion buying of near 160 tons in March lends some additional support to the yellow metal prices.

In contrast, the upbeat U.S. data and faster vaccination shots in the United States and the United Kingdom probes the risk-off market mood, which becomes the key factor keeping a lid on any additional gains in yellow metal prices. Also, capping the gains could be the firmer U.S. dollar as the price of bullion is inversely related to the price of the U.S. dollar. The U.S. dollar was supported by the downbeat market mood, which increased the safe haven demand in the market and contributed to its gains. As of writing, the yellow metal price is trading at 1,778.45 and consolidating in the range between 1,773.26 and 1,783.66.Global equity markets failed to extend their overnight bullish performance. During the Asian trading session amid US-China and the Washington-Kremlin tussles, the mood turned sour, which worsened over time and gained major market attention. Besides, the risk barometer was further pressured by the chatters surrounding U.S. President Joe Biden’s $2.25 trillion infrastructure spending. Meanwhile, the ever-increasing cases of coronavirus (COVID-19) and hike in the death toll exerted some additional downside pressure on the market trading sentiment. The U.S. Republicans showed their dislike for President Biden’s tax hike again while showing a willingness to asset the infrastructure spending if the Democratic Party member steps back on the outlays. There are also some rumors that President Biden is set for stepping back from tax hike proposals.

At the coronavirus front, the ever-rising number of COVID-19 death toll surged past three million, amid the pandemic’s resurgence in Europe, India, and some other Asian nations like the Philippines. Meanwhile, the slower-than-expected COVID-19 vaccine rollout and the rise in mutant strains keep the investors worried. As per the latest report, Hong Kong recently banned flights from Pakistan, India, and the Philippines after reporting some mutated N501Y COVID-19 strain cases. This news added to the market’s risk-off sentiment and helped the gold prices to stay bid.

Across the ocean, the reason for the buying trend around the gold prices could also be attributed to the fresh reports suggesting that the Dragon Nation recently eased restrictions for banks importing the yellow metal after multiple months of slow buying. As per the latest report, China raised its gold imports, signalling that demand could be improving. Commercial banks were also allowed to import massive amounts of the precious metal into the country. The news hints at about 150 tons of gold imports against the recent average of 10 tons and the year 2019 buying 75 tons monthly. Meanwhile, India’s record bullion buying of near 160 tons in March also supports the yellow metal prices. As we are well aware, China and India are the world’s largest bullion consumers. In that way, the increase in buying should help the bullion.

As a result of the risk-off market mood, the broad-based U.S. dollar managed to extend its overnight winning streak. It remained bullish during the Asian session as investors started to favor the safe-haven assets in the wake of risk-off market sentiment. However, the U.S. dollar gains were further bolstered by the upbeat U.S. economic data. Therefore, the upticks in the U.S. dollar become the key factor that keep a lid on any additional gains in the bullion prices as the price of bullion is inversely related to the price of the buck. In the absence of the major data/events on the day, the market traders will keep their eyes on the updates concerning the U.S. stimulus package. Any negative news about the U.S. stimulus can further sour the market sentiment on the day. In the meantime, risk catalysts like geopolitics and the virus woes will not lose their importance.

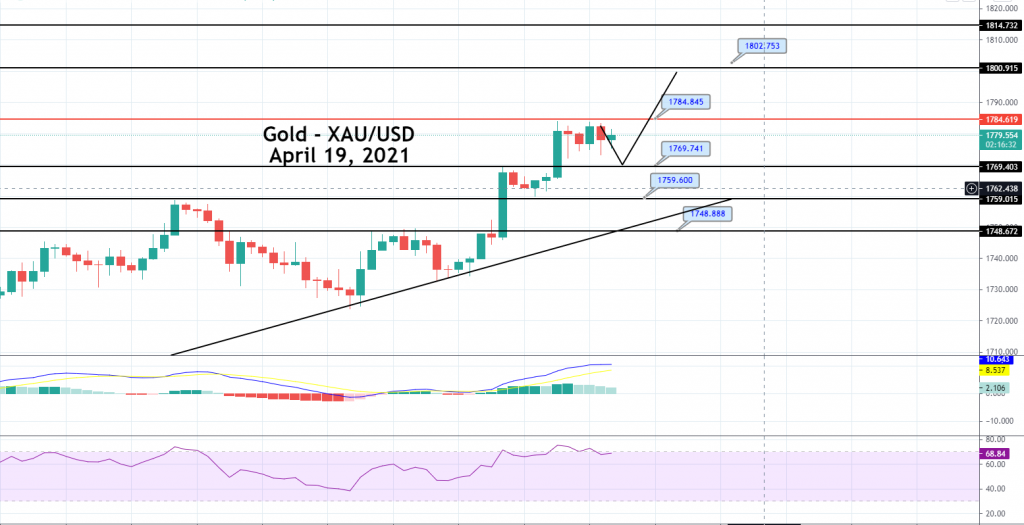

Gold Daily Support and Resistance

S2 1751.67

S3 1764

Pivot Point 1773.93

R1 1786.26

R2 1796.19

R3 1818.45

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |