62% Fibonacci Resistance In View For Bitcoin (BTC)

The crypto-sphere has been relatively quiet today as the major coins are trading mixed. Over the past 24-hours, Bitcoin BTC (-0.72%), Ethereum ETH (+2.09%), and Litecoin LTC (-1.09%) are all hovering near flat. With the April Fed announcements due out at 2:00 PM EST today, it looks like investors are in a holding pattern ahead of the FOMC’s commentary.

However, there is one breaking news item facing cryptocurrencies that is worth noting. In a press release from earlier today, the U.S. Securities and Exchange Commission (SEC) moved back the approval timeline for the VanEck BTC ETF offering. In the statement, the SEC provides that within 45-90 days, they will make a judgment on a proposed CBOE BZX Exchange rule change that would allow or trade of a BTC ETF. This is an interesting point in that it further delays VanEck’s final Bitcoin ETF approval. Up to this point, the SEC has refused to sign off on any such offerings.

On the Fed front, Chairman Jerome Powell is scheduled to give his policy presser this afternoon at 2:30 PM EST. Most analysts agree that it is to be more of the same out of Powell. Be on the lookout for a dovish tone and more talk of extended QE. Of course, if there are any surprises, the FX Leaders team will bring you the key events.

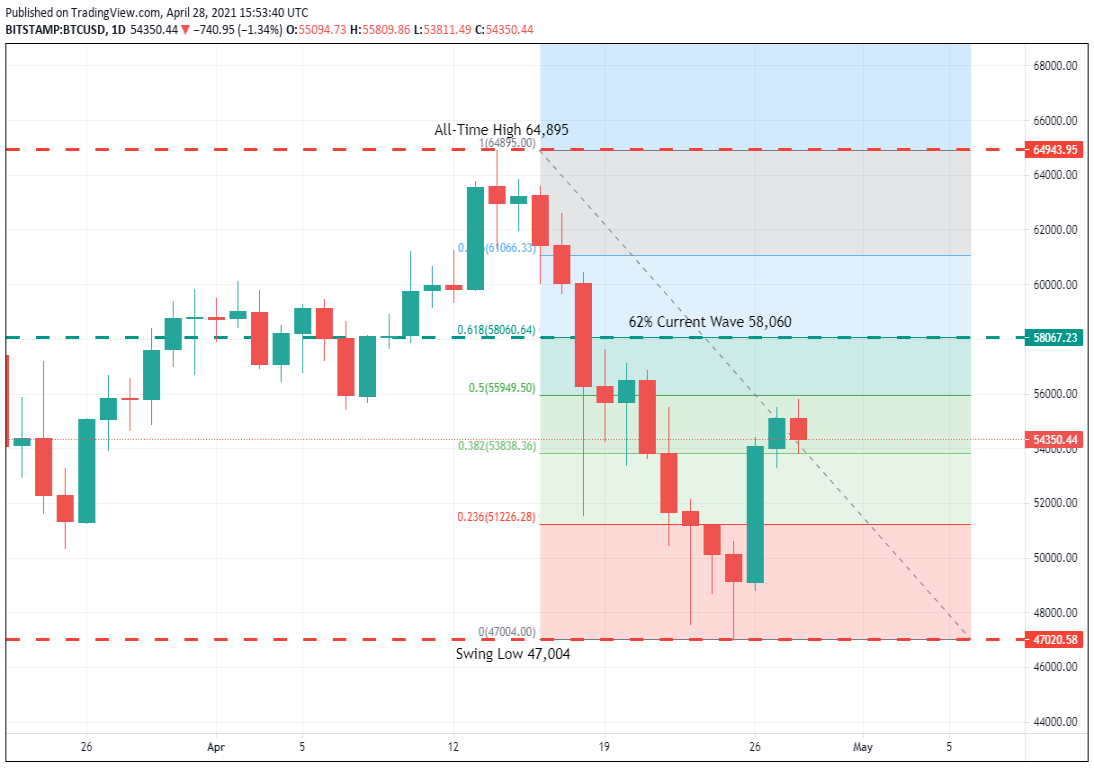

Bitcoin (BTC) Approaches Daily 62% Resistance Level

It has been a solid week for Bitcoin as traders have rallied values more than $4000. For now, it looks like crypto traders maintain the BTC bullish bias that has dominated 2021.

Bottom Line: At press time (about 12:45 PM EST), there is one key level on my radar for Bitcoin ― $58,060. This is April’s 62% Fibonacci retracement and could be an important resistance level moving forward.

Until elected, I’ll have sell orders in the queue from $57,900. With an initial stop loss at $62,000, this trade produces 7% ($4100) on a standard 1:1 risk vs reward trading plan.