USD Closes April’s Forex Trade On The Bull

April has been a key month on the forex, highlighted by a fading USD and rising inflation. With only a few hours left until we flip the calendar to May, the Greenback is on the bull. Key movers have been the EUR/USD (-0.69%), USD/JPY (+0.35), and the GBP/USD (-0.81%). Right now, sentiment is positive as institutional money adjusts its end-of-month ledgers.

On the economic calendar, there were a few noteworthy reports out this morning. Here’s a brief look at the headliners:

Event Actual Projected Previous

Core PCE Price Index (MoM) 0.4% 0.3% 0.1%

Core PCE Price Index (YoY) 1.8% 1.8% 1.4%

Personal Income (MoM) 21.1% 20.3% -7.1%

Personal Spending (YoY) 4.2% 4.1% -1.0%

Well, it’s official ― the era of U.S. inflation is upon us. In all honesty, the Personal Income and Personal Spending stats are meaningless products of COVID-19 governmental fiscal policy. However, the uptick in the monthly and yearly Core PCE Price Index is a big deal. Given last year’s launch of COVID-19 stimulus and the Fed’s unlimited QE program, today’s inflation should be no surprise.

Historically, inflation comes on fast and accelerates until checked; who is going to check it this time around? Fed Chairman Powell appears comfortable with the recent rise in prices, crediting the move to “transitory” forces. With May on the immediate horizon, it looks like forex players are considering a forthcoming shift in policy tone.

April’s Forex Action Is Nearly In The Books

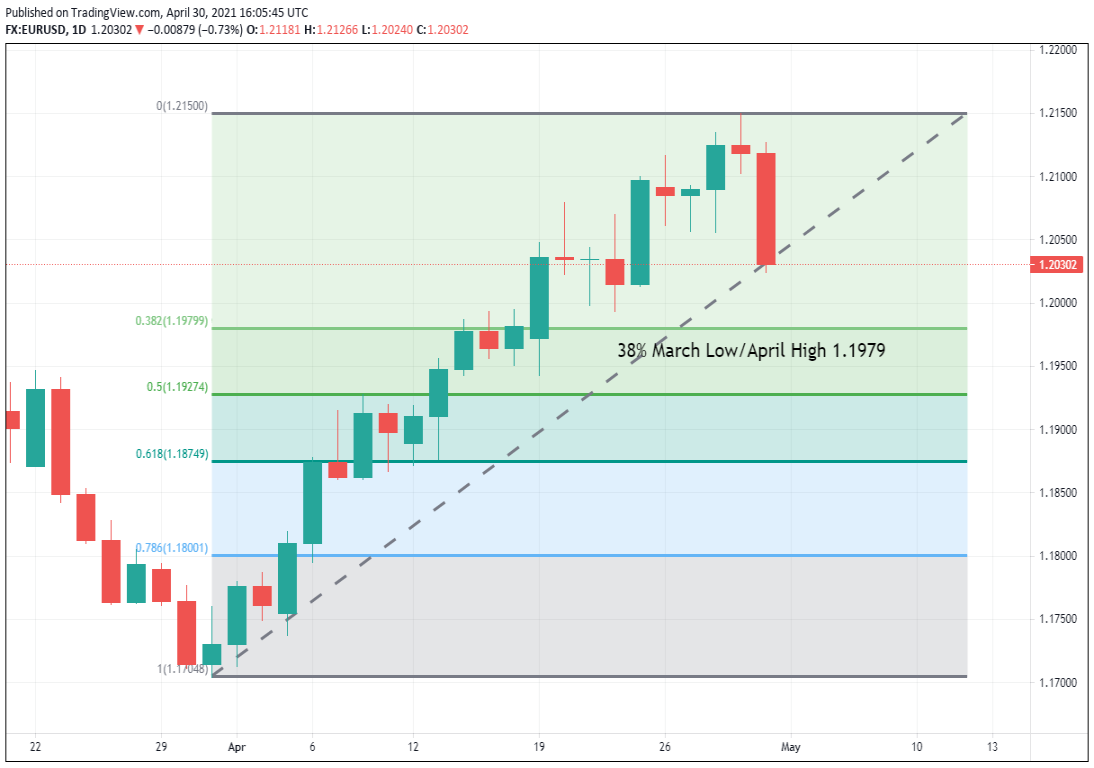

For the EUR/USD, it has been a big session. Rates are off dramatically and driving toward a key Fibonacci support level. Will forex bidders step up at 1.1979?

Bottom Line: As long as 1.2150 is a viable swing high, I’ll have orders in the queue from just above the 38% retracement at 1.1985. With an initial stop loss at 1.1874, this long forex trade produces 111 pips on a standard 1:1 risk vs reward ratio.