EUR/USD Facing MAs Higher, After Services Come Out of Recession in Europe

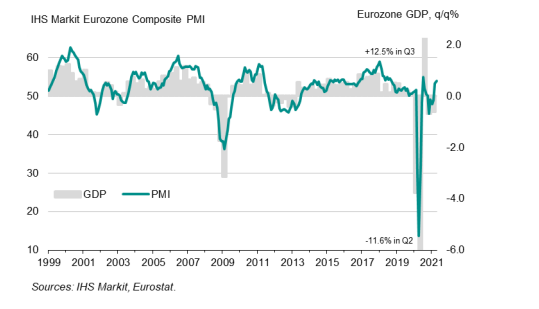

The service sector has been the most affected during the coronavirus times; it fell in recession together with manufacturing a year ago during the first lock-downs, but manufacturing bounced back quite fast. Services took longer to rebound, but they fell in recession again in Q4 of 2020 due to the new wave of restrictions. While manufacturing has been booming, services remained in recession in Europe, but at last they are coming out of recession now, as today’s report showed.

EUR/USD climbed above 1.20 again, but the bullish momentum seems weak, while the 20 SMA (gray) and the 100 SMA (green) are waiting above to provide resistance at 1.2030. We are following this pair and might open a sell forex signal if the price moves up there.

Latest data released by Markit – 5 May 2021

- April final services PMI 50.5 vs 50.3 prelim

- Composite PMI 53.8 vs 53.7 prelim

“April’s survey data provide encouraging evidence that the eurozone will pull out of its double-dip recession in the second quarter. A manufacturing boom, fueled by surging demand both in domestic and export markets as many economies emerge from lockdowns, is being accompanied by signs that the service sector has now also returned to growth.

“Barring any further wave of infections from new variants, Covid restrictions should ease further in the coming months, driving a strengthening of service sector business activity which should gain momentum as we go through the summer.

“The intensity of the rebound will naturally depend on the extent to which Covid restrictions can be removed – and some measures relating to international travel are likely to remain in place for some time to come – but experience in other countries hints that the bounce in domestic activity could be strong as pent up demand and savings power a surge in spending.

“While the revival in the economy is bringing a rise in inflationary pressures, these so far seem largely confined to the manufacturing sector, with service sector costs – which form a major component of the core inflation measures tracked by the ECB – remaining only modest.”