ISM Services Cool in US, ADP Employment Jumps

The service sector has been catching up with manufacturing in the US in recent months, as both sectors are surging now. ISM services cooled off in April, as today’s report showed, but it still remains above 60 points which is great, while PMI services showed a further expansion last month.

So, services are in a really good shape and they are coming back in Europe as well, after they left behind recession last month. The employment keeps improving, with jobless claims on the decline, while the ADP and ISM employment numbers increased further in April. So, the US economy keep expanding despite the slight retreat in ISM services for April and the USD is gaining pace now, with EUR/USD testing 1.20 again.

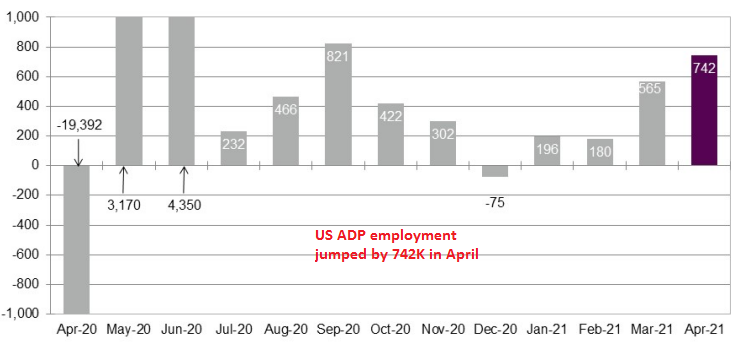

April 2021 US jobs report from ADP

- April US employment 742K vs 850K expected

- Prior was 517K (revised to 565K)

- Small businesses +235K vs 174K prior

- Midsized 230K vs 188K prior

- Larger 277K vs 155K prior

- Goods sector 106K vs 80K prior

- Service sector 636K vs 437K prior

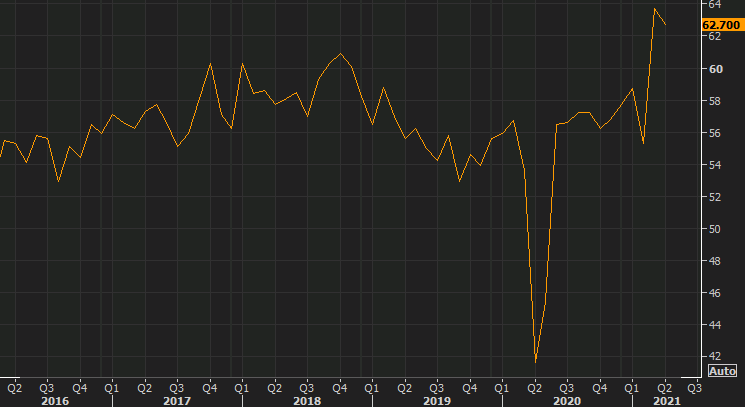

April ISM Services Report

- ISM services index April 62.7 points vs 64.1 expected

- March ISM services index was 63.7 points

- New orders 63.7 points vs 67.2 prior

- Prices paid 76.8 points vs 74.0 prior (highest since at least 2008)

- Employment 58.8 points vs 57.2 prior

- Full report

More details:

- Production 62.7 vs 69.4 prior

- Backlog of orders 55.7 vs 50.2 prior

- New export orders 58.6 vs 55.5

- Imports 55.7 vs 50.7 prior

- Supplier deliveries 66.1 vs 61.0

- Inventory change 49.1 vs 54.0

- Inventory sentiment 46.8 vs 52.7 prior

The fall in inventories mirrors what we saw in the manufacturing index. Bottlenecks are increasingly weighing on activity and I think that’s a big emerging story.

- “Restaurant capacity is increasing quickly as restrictions are removed. Consumers have pent-up demand; sales are increasing, and the labor pool is tight. Supply chain is challenged at every level as businesses across the U.S. ramp up.” (Accommodation & Food Services)

- “Delays in container deliveries are now impacting our business.” (Agriculture, Forestry, Fishing & Hunting)

- “Consistent with the past year, labor continues to be the biggest issue we are facing. Finding and retaining labor – skilled and unskilled – is highly challenging and frustrating. As the challenges continue, we are not accepting all the work that we could if we had the labor.” (Construction)

- “Higher volume of activity in anticipation of a reopening of the campus in the fall of 2021.” (Educational Services)

- “Conditions are good for the market/industry. Continuing to trend under budget for operating expenses. Outlook is positive for the second quarter of 2021.” (Finance & Insurance)

- “Elective surgeries coming back to pre-COVID-19 rates. Patient census continues to drop, as it does this time of year.” (Health Care & Social Assistance)

- “Overall, there is pricing pressure for goods and services in the market.” (Information)

- “Supply has been dwarfed by demand [and] ocean-transport logistics imbalances with ships and containers. North America parcel carriers swamped with volume-processing constraints, and highway carriers can’t supply drivers, regardless of choked original equipment manufacturer [OEM] truck orders. Rail intermodal is only competitive among two dozen or so origins, to about as many destinations.” (Professional, Scientific & Technical Services)

- “Business is generally upbeat. There is pent-up demand and resources, especially people. The pandemic, while not over, is subsiding in most places with the vaccines. Many people who were previously unable to think about relocating for jobs are now doing so. Other areas of the economy are opening up. Many medical treatments that were not critical and were put off are now being administered.” (Public Administration)

- “Business levels are quite strong as we head into the spring construction season.” (Real Estate, Rental & Leasing)

- “Business optimism is high. Orders are picking up, and there is a strong demand for capital investments.” (Utilities)

- “Business is very robust, but logistics and supply cannot keep up.” (Wholesale Trade)