Tron (TRX) Hits $0.14, Key Resistance Levels In View

One of the biggest crypto stories of 2021 has been the rise of Tron (TRX). The little-known coin has rallied nearly 875% in the past 12-months, with most of that coming since January 1st. Now, prices are holding firm in bullish territory near $0.14.

So, what is Tron? Tron is a decentralized platform that specializes in digital entertainment infrastructure. Essentially, Tron aims to match content creators and consumers through integrating person-to-person blockchain technology. In doing so, the company can cut out the middle-man and reduce entertainment costs for consumers while boosting profitability for creators.

Although the Singapore-based Tron is only a few years old, it is becoming a major player in the online space. Featuring more than 33 million accounts and nearly 2 billion transactions, Tron lauds itself as being the “fastest-growing public chain.” For crypto traders and investors, the fledgling coin’s upside is growing increasingly attractive.

Tron Holds The Line At $0.1400

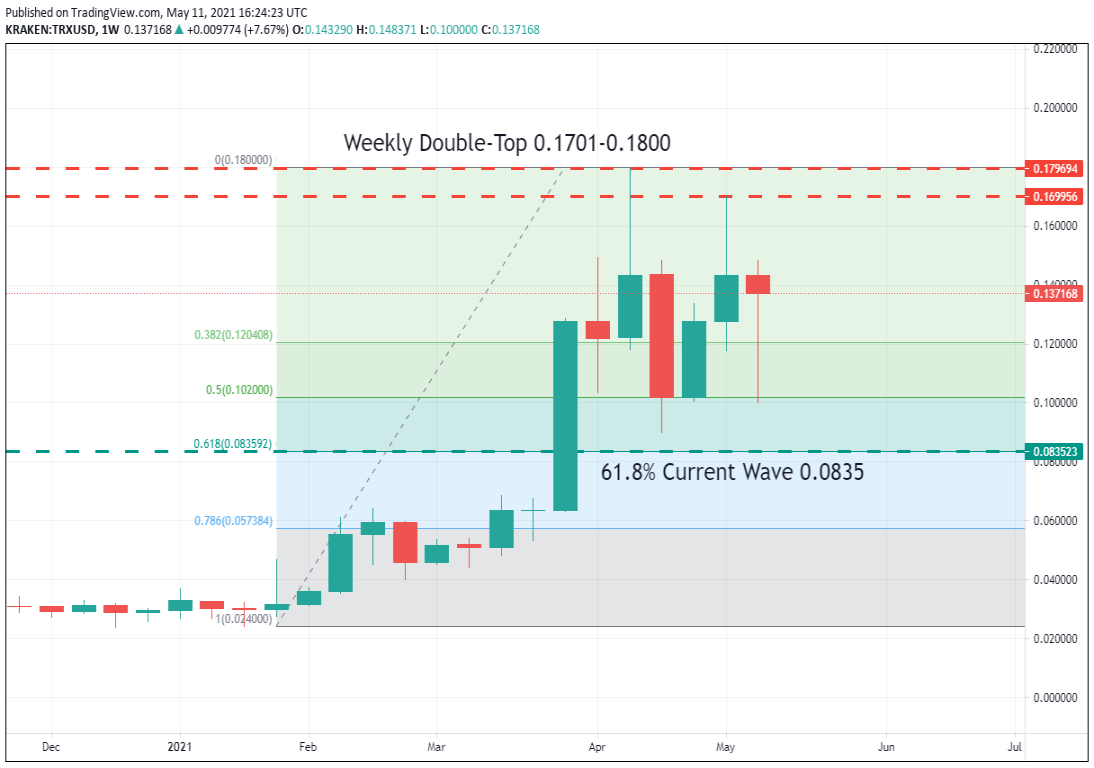

In a Live Market Update from yesterday, I outlined a key resistance area for Tron. This technical zone is now coming into view. Below is a closer look at the weekly double-top pattern that is set up between $0.1700 and $0.1800.

For the time being, here are the technical levels I will be watching in TRX:

- Resistance(1): Weekly Double-Top, 0.1701-0.1800

- Support(1): 62% Fibonacci Retracement, 0.0835

Bottom Line: As we move deeper into Q2, I expect Tron and many other altcoins to enter consolidation phases. If this proves to be the case, then selling the weekly double-top pattern in TRX may turn out to be a good play.

Until elected, I’ll have sell orders in the queue from $0.1700. With an initial stop loss at $0.2050, this trade produces 17.6% ($0.03) on a slightly sub-1:1 risk vs reward ratio.