Daily Support Levels In View For The USD/CAD

WTI crude oil is on the move south as fresh COVID-19 fears begin to grip the commodities markets. At press time, CME WTI futures are on the bear, falling nearly 1% for the session. Subsequently, the USD/CAD is extending its current two day winning streak rallying above 1.2550. For now, it looks like the energy markets and Loonie are preparing for the rapidly approaching fall season.

On the traditional forex news front, there weren’t a whole lot of official reports out today. However, two facing the USD/CAD are worth noting:

Event Actual Projection Previous

Canada Manufacturing PMI (July) 56.2 NA 56.5

US Factory Orders (MoM, June) 1.5% 1.0% 2.3%

All in all, this isn’t a bad group of figures and suggests that North American manufacturing is on the rebound. US orders are up and the Canadian PMI has held firm. So, while these aren’t primary economic metrics, they do indicate that things are currently stable. Of course, all of that can change if the Delta variant prompts another set of draconian lockdowns.

Let’s take a look at the daily technicals for the USD/CAD and see if we can spot a trade or two.

USD/CAD Rallies, Extends Early Week Gains

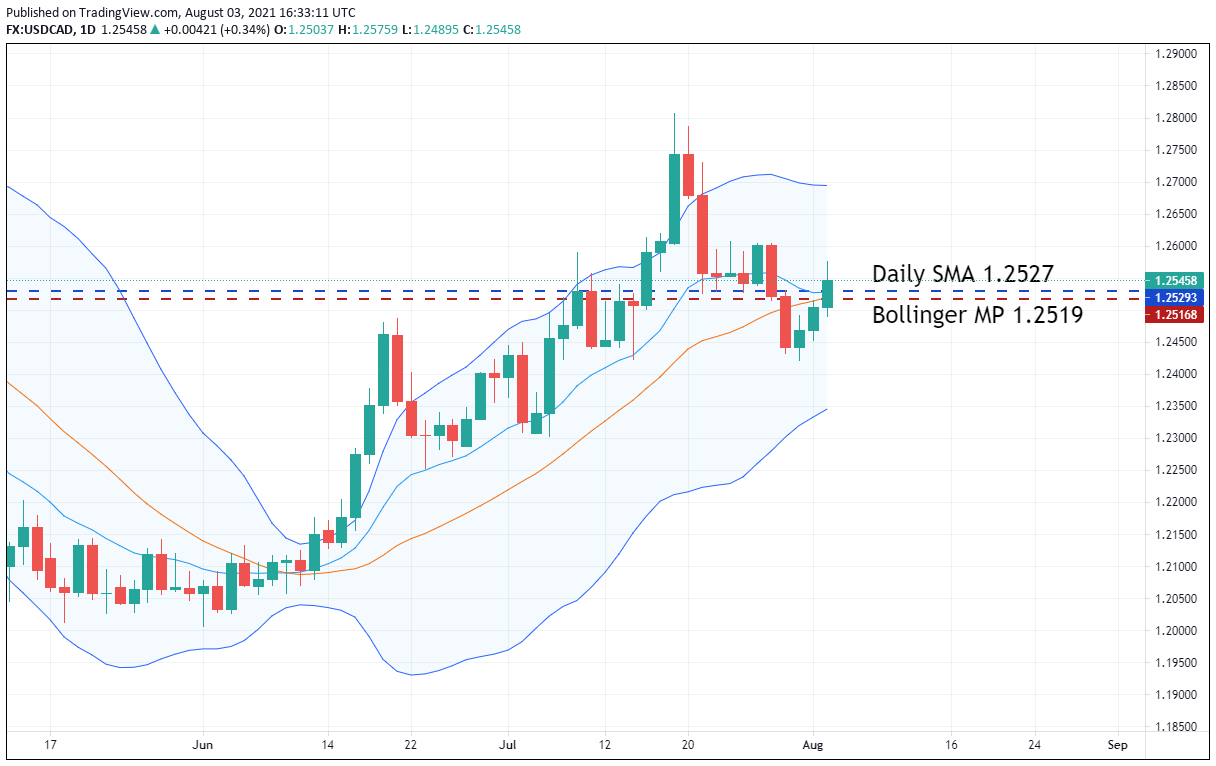

Over the course of summer 2021, the action in the USD/CAD has been decisively bullish. This comes as a bit of a surprise given this year’s strength in WTI crude oil. For now, the intermediate-term uptrend in this pair remains intact.

Here are two levels to watch for the remainder of today’s session:

- Support(1): Daily SMA, 1.2527

- Support(2): Bollinger MP, 1.2519

Bottom Line: For the rest of the trading day, I’ll have buy orders in the USD/CAD queue from 1.2529. With an initial stop loss at 1.2494, this trade produces 25 pips on a slightly sub-1:1 risk vs reward management plan.