On Wednesday, the direct currency pair,

EUR/USD, is trading sideways within a narrow trading range of 1.1895 to 1.1850. It seems like traders are waiting for US NFP and Advance NFP data to be released on Wednesday and Friday, respectively.

Weakness in the Dollar Supports EUR/USD at $1.1850

The US dollar index dropped for the day, reaching the 91.89 level on Tuesday. The weakness in the US dollar was due to the cautious behavior of the traders, who are waiting for the release of the US jobs report scheduled for release on Friday.

Investors wanted to get clues about the progress in the jobs market, as this is what will decide the timeline of the tapering of asset purchases by the Federal Reserve.The hesitation of traders to enter the market with sizeable bets ahead of the jobs data kept the greenback under stress for the day. The weakness of the US dollar then kept the losses in the EUR/USD currency pair limited for the day.

Quick Update on Economic Releases

On the data front, at 12:00 GMT, the Spanish Unemployment Change for July came in at -197.8K against the predicted -115.5K, which supported the single currency Euro and limited the declining prices of the EUR/USD pair. At 14:00 GMT, the PPI from the whole bloc for June remained flat, in line with the expectations of 1.4%.

From the US side, at 19:00 GMT, the Factory Orders for June came in, showing an increase to 1.5%, against the estimated 1.0%, which supported the US dollar and added to the losses in the EUR/USD. At 19:01 GMT, the IBD/TIPP Economic Optimism for August came in, showing a decline to 53.6 against the predicted 55.3, which put pressure on the US dollar and limited the downward momentum of the EUR/USD. The Wards Total Vehicle Sales also dropped, coming in at 14.8M, against the expected 15.2M, weighing on the US dollar and limiting the downward momentum in the EUR/USD pair.

Meanwhile, according to the WHO, the number of coronavirus cases has passed a milestone of 60 million since the pandemic began, and the death toll recorded in the European region has reached 1.2 million. The rising number of coronavirus cases in the whole bloc, due to the spread of the Delta variant, has caused many European countries to re-impose restrictions, weighing heavily on the single currency Euro, thereby keeping the EUR/USD currency pair under pressure for the day.

EUR/USD – Daily Technical Levels – All Eyes on 1.1850

Support Resistance

1.1844 1.1885

1.1828 1.1910

1.1803 1.1926

Pivot Point: 1.1869

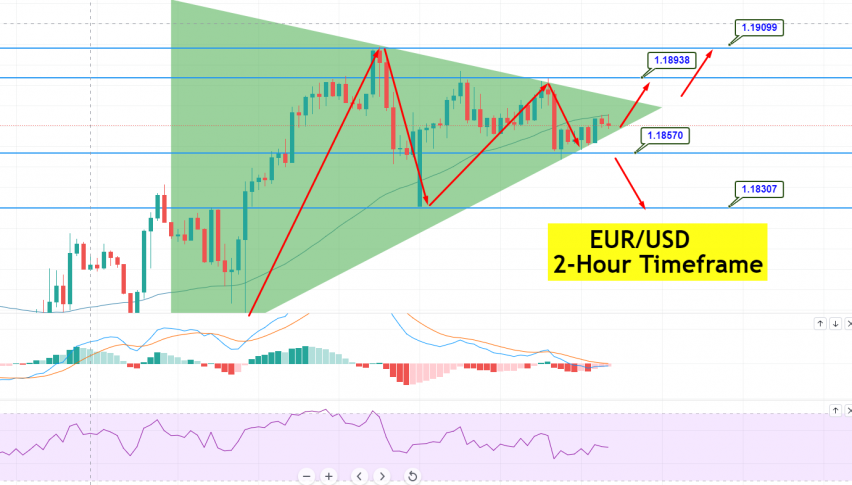

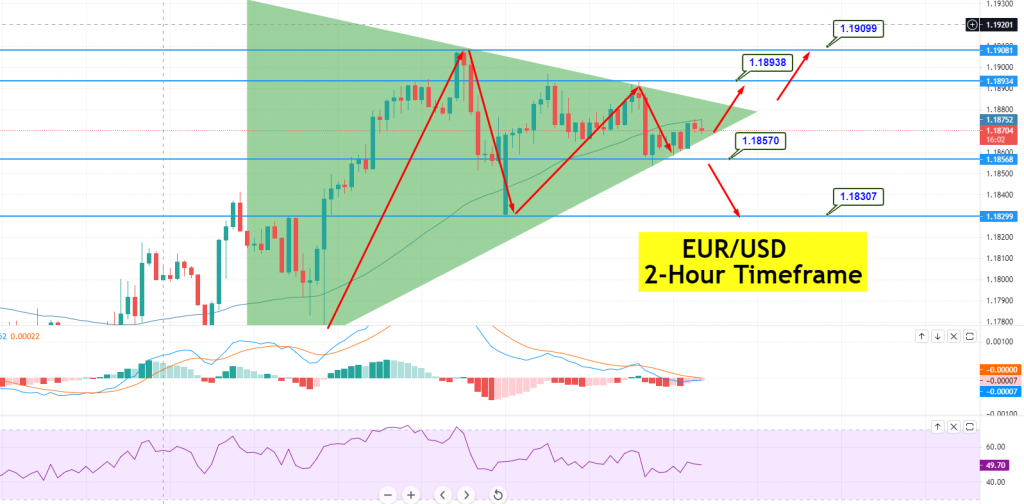

EUR/USD – Technical Analysis – Can Euro Violate Triangle Pattern

The EUR/USD pair is trading with a neutral bias at the $1.1870 level. On the 2-hour timeframe, the EUR/USD pair is gaining support at the 1.1850 level. This support level is extended by an upward trendline or, more precisely, a symmetrical triangle pattern.

The indicators, like the 50 EMA, the MACD and the RSI, are rather messed up, giving different signals. Therefore, we need to focus on the US ADP data and technical levels if we want to perform a trade. On the higher side, the EUR/USD may face strong resistance at the 1.1890 level, and a bullish breakout at this level could lead the pair towards the 1.1926 level, whereas a breakout at 1.1850 could lead the pair towards 1.1830. Let’s brace for the US ADP Non-farm figures, before we can predict further movement in the EUR/USD pair. Good luck!