GBP/USD Makes the Break, As UK Retail Sales Turn Positive Again

GBP/USD is turning bearish on larger timeframe charts and the economic data is weakening

GBP/USD has been one of the most bullish pairs since March 2020, when it made a reversal at 1.14 and began a long-term bullish trend. This pair gained more than 28 cents, as it climbed above 1.42 in May this year. Although it seems like the trend might be changing now. The smaller period moving averages which were providing support on the daily chart, such as the 50 SMA (yellow) and the 100 SMA (green) were broken in June.

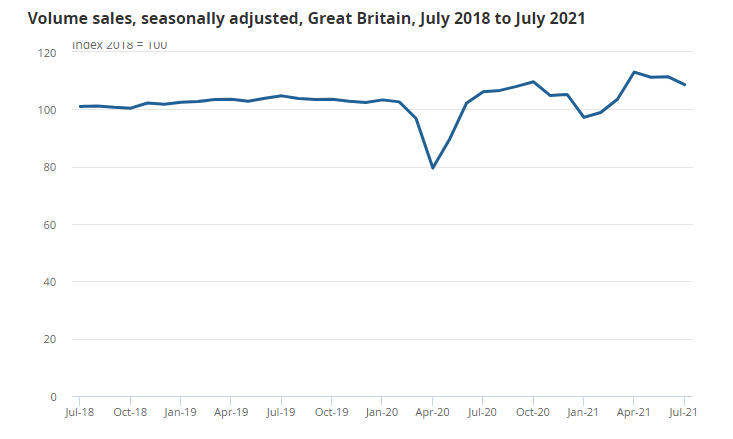

That was the first bearish signal, while now the 200 SMA (purple) has also been broken. The UK economy is showing signs of weakness as well now, after the expansion in the previous months following the reopening. The retail sales report showed a considerable decline in sales during July, while the USD is picking up some steam, which points further down for this pair. So, now we are changing the bias for GBP/USD and will try to sell retraces higher.

GBP/USD Technical Analysis – GBP/USD Daily Chart

The 200 SMA has been broken in GBP/USD

Latest data released by ONS – 20 August 2021

- July retail sales MoM -2.5% vs +0.4% expected

- June sales were +0.5%; revised to +0.2%

- Retail sales YoY +2.4% vs +6.0% expected

- Prior sales YoY were +9.7%; revised to +9.2%

- July core retail sales ex. autos, fuel MoM -2.4% vs +0.3% expected

- June core sales were +0.3%; revised to 0.0%

- Core sales YoY ex. autos, fuel +1.8% vs +5.7% expected

- Prior core sales YoY were +7.4%; revised to +6.8%

A considerable miss as UK retail sales activity sees further moderation after consumption levels spiked on reopening demand since April. Retail sales volumes for July were still seen 5.8% higher as compared to February 2020 i.e. pre-pandemic.

This fall is broadly in line with data on UK spending on debit and credit cards, based on CHAPS payments made by credit and debit card payment processors, which also reported a fall in spending on staples (such as food) between June and July alongside an increase in social spending (such as eating out and takeaways), which may be linked to the further lifting of hospitality restrictions in July.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account