Decisive Time for USD/CAD at the 50 Daily SMA, After Another miss in US Employment

USD/CAD finally made a reversal higher, after being bearish from March last year. It declined from 1.4660s to 1.20, where it started reversing higher. The reverse began at the beginning of June and then it started going up, getting pretty close to 1.30 before pulling back down, after forming an upside-down pin, which is a reversing signal. But there have been some decent pullbacks during this bullish trend, and this one seems like another one of those. The US employment report has just been released, and it should get this pair going.

USD/CAD facing the 50 SMA now

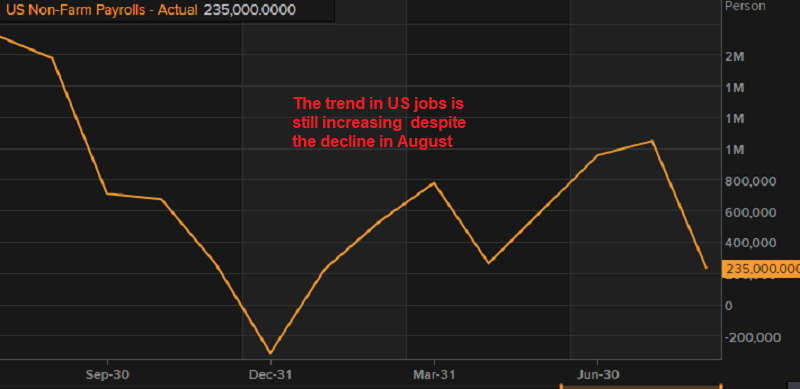

August 2021 US non-farm payrolls data

- August non-farm payrolls +235K vs +750K expected

- Prior was 943K (revised to 1053K)

- Two month net revision +134K

- Unemployment rate 5.2% vs 5.2% expected

- Prior unemployment rate 5.4%

- Participation rate 61.7% vs 61.6% expected (was 62.8% pre-pandemic)

- Prior participation rate 61.7%

- Underemployment rate 8.8% vs 9.5% expected (9.2% prior)

- Average hourly earnings +0.6% m/m vs +0.3% expected

- Average hourly earnings +4.3% y/y vs +4.0% expected

- Average weekly hours 34.7 vs 34.8 expected

- Change in private payrolls +243K vs +665K expected

- Change in manufacturing payrolls K vs +25K expected

- Long-term unemployed at 3.2m vs 3.4m prior

- The employment-population ratio, at 58.5% vs 58.5% prior (61% pre-pandemic)

- Full report

The household survey was decent, with unemployment continuing to fall, but the establishment survey was poor, with ‘leisure and hospitality’ adding no jobs, in a sign that pandemic-related re-hiring stalled during the month. In particular, there were 42K job losses in food services and drinking places.