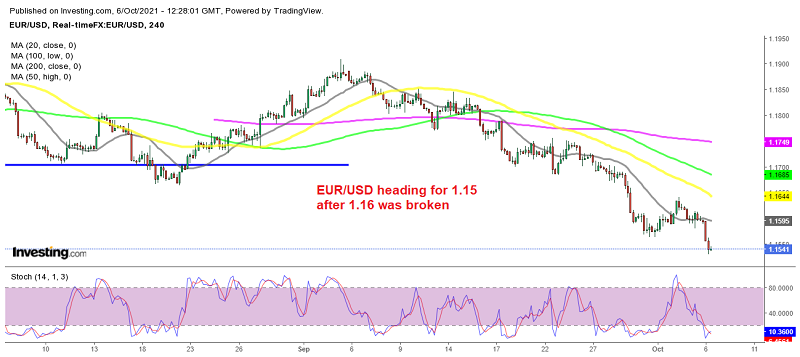

EUR/USD Continues the Decline After the Positive US ADP Employment Report, With More Room to Run

EUR/USD continues to slip lower with the target at 1.15 first and then 1.10

EUR/USD has turned increasingly bearish over the past month, since early September. The pace of the decline has been quite strong, with larger MAs unable to catch up. The economic data is going this way for this pair, with the Eurozone economy weakening in September, particularly services, while the US economy is expanding, as the ADP employment showed today and the ISM services did so yesterday, showing an expansion.

The ECB is also remaining on hold regarding everything, while the FED announced the beginning of the taper process in December and hiking rates as well in the coming months, as inflation remains above 5%. So,

EUR/USD has more room to fall, until 110. Below is today’s ADP employment report for September:

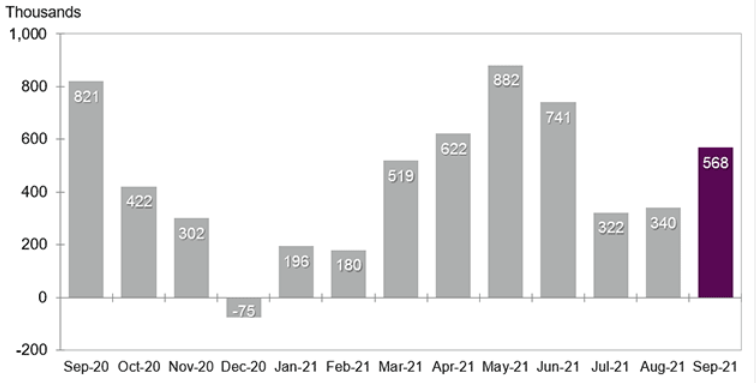

The September 2021 US employment report from ADP

- September US ADP employment +568K vs +428K expected

- Prior was 374K (revised to 340K)

- Small business +63K vs +86K prior

- Midsized +115K vs +149K prior

- Large +390K vs +138K prior

- Goods-producing jobs +102K vs +45K prior

- Service-providing jobs +446K vs +329K prior

Non-farm payrolls are expected at 473K on Friday. The ADP report has a poor track record of predicting non-farm payrolls, particularly since the pandemic, but last month it did foreshadow a soft reading. Whether that’s luck or whether that’s improved tracking is something we’ll find out on Friday but I don’t think anyone is putting too much stock in ADP at the moment. The market reaction has been minimal.

“The labor market recovery continues to make progress despite a marked slowdown from the 748,000 job pace in the second quarter,” said Nela Richardson, chief economist, ADP. “Leisure and hospitality remains one of the biggest beneficiaries to the recovery, yet hiring is still heavily impacted by the trajectory of the pandemic, especially for small firms. Current bottlenecks in hiring should fade as the health conditions tied to the COVID-19 variant continue to improve, setting the stage for solid job gains in the coming months.”

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account