Solana (SOL) and Terra (LUNA) Price Jumping on the First Opportunity, Showing Buying Pressure

Some cryptocurrencies have been weak since September, such as Litecoin, Ripple and Cardano, finding a reason to decline, while some others have been bullish and only need a small incentive to turn bullish and make decent gains. Solana and Terra Luna are among the bullish cryptocurrencies as they keep making new highs.

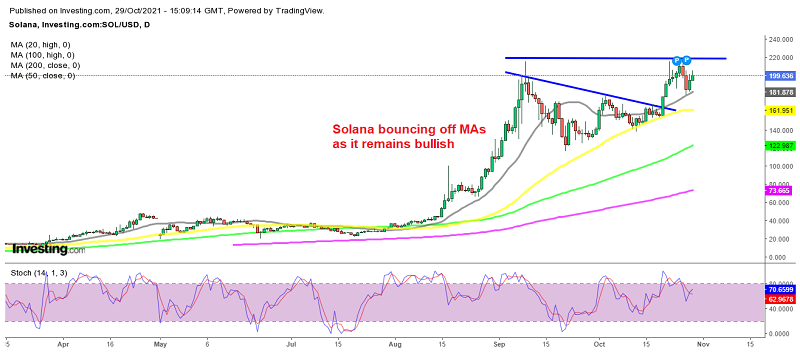

Solana Daily Chart Analysis – SOL/USD Bouncing Off the 20 SMA

Solana made a massive surge during August and early September, increasing from around $22 to $215, which means an almost 1,000% appreciation. In the second half of September, the price retreated, but the 50 SMA (yellow) was acting as support on the daily chart, pushing the lows higher.

A triangle was forming and we did predict the bullish breakout, as the trading range was narrowing. The breakout happened last week and SOL/USD printed a new high just below $220. Earlier this week we saw a retreat lower, as Bitcoin fell below $60,000, but the decline stopped at the 20 SMA (gray) and is bouncing from there. This shows strong buying pressure, since buyers are jumping in at the first opportunity which is the 20 SMA.

Terra (LUNA) Daily Chart Analysis – LUNA/USD Bouncing Off the 50 SMA

LUNA also had a great run during August and the bullish run hasn’t ended yet. The burning of around 10% of the total LUNA coins has been keeping the demand up for this crypto, since it means fewer coins in circulation and higher demand. Besides that, the Cosmos Inter-Blockchain Communication IBC bridge went live on the Solana network, making it more interconnected with other crypto networks.

The 50 SMA keeps pushing Terra LUNA higher

As we see from the chart above, March’s high of around $22 turned into support for Terra LUNA, while the 50 SMA (yellow) has been pushing the lows higher during pullbacks. The price bounced off that moving average again this week, so LUNA/USD will probably make a new high soon and finally breach the $50 level.