Who Wants to Buy the Retreat in Crude Oil on Surging US CPI Inflation?

Crude Oil has been on a strong bullish trend for more than a year, since the reversal from the deas in April 2020. US WTI crude has printed a high of $85.40, but the real resistance comes at $85. That area has been rejecting the price recently and Oil is retreating lower now after the last rejection.

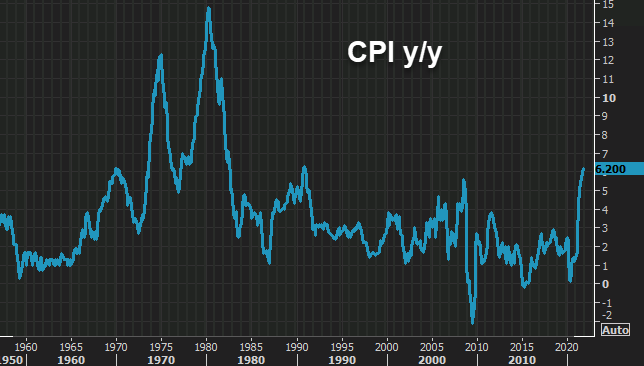

The US inflation report came out strong again, sending the CPI (consumer price index) to 6.2% which should keep crude Oil bullish. although WTI Oil is on a pullback mode now, so we will look to buy Oil around $80, just below the 200 SMA, after some weak stops get flushed.

US October 2021 CPI Consumer Price Index

- October CPI YoY +6.2% vs +5.8% expected

- Highest since 1990

- September CPI YoY was 5.4%

- CPI MoM +0.9% vs +0.6% expected

- September COI MoM was +0.2%

- Real weekly earnings -0.9% vs +0.8% prior

Core inflation:

- September core CPI YoY excluding food and energy +4.6% vs +4.3% expected

- September Core CPI YoY was +4.0%

- Core CPI MoM +0.6% vs +0.4% expected

- Prior core MoM +0.2%

- Full report

Note on the consensus numbers: I’ve seen some different estimates that were mostly lower than what I have here. So the numbers beat the estimates but perhaps by even more than is shown here. The US dollar has jumped on the headlines around 50 pips across the board.

More details:

- CPI food +0.9% m/m

- Housing +0.7% m/m

- Owners’ equivalent rent +0.4%

- CPI energy +4.8%

- Gasoline +6.1%

- New vehicles +1.4%