Services Dive into Contraction in Europe, Ahead of the ECB Meeting

The next European Central Bank meeting is scheduled for today, although markets are not expecting any action, because the ECB has made this clear in recent comments. Other major central banks have started tightening their monetary policy and some are increasing interest rates already. The FED is expected to hike rates by 0.50% in next month’s meeting, while the Bank of England hiked rates last month, and is expected to do so again today.

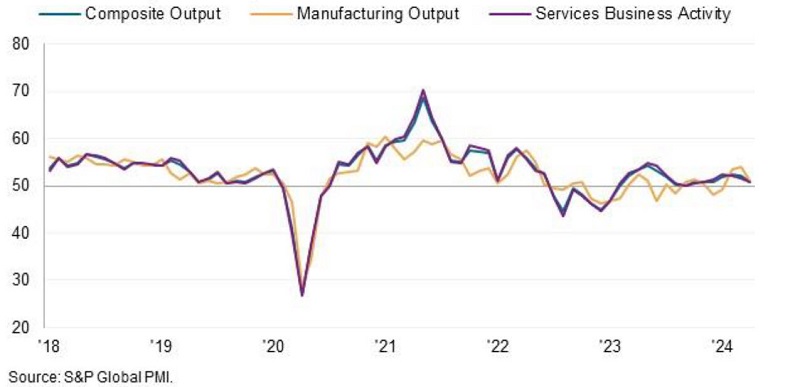

turned bullish this week, ahead of the ECB meeting, indicating some hawkish remarks, but it has stopped at the 20 daily SMA (gray) now. The Italian and Spanish services reports today showed that this sector dived into contraction again last month, thanks to coronavirus restrictions. So, that might be another excuse for the ECB to keep interest rates on hold.

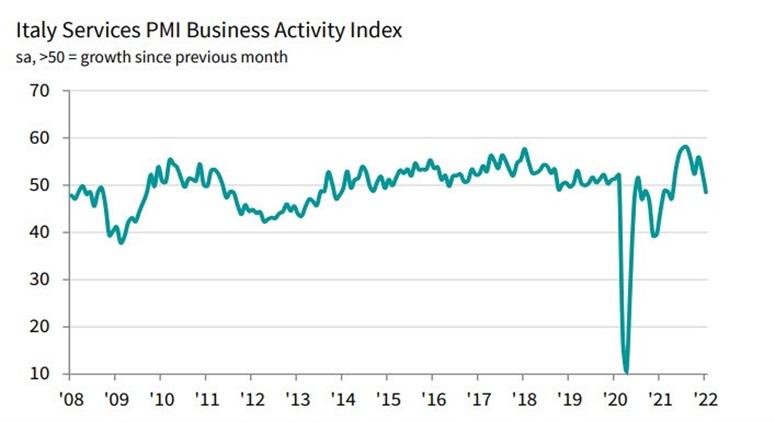

Italian Services PMI Report January 2022

- Italy, January services PMI 48.5 points vs 53.0 prior

- December services were 53.0 points

- Composite PMI 50.1 points

- Prior composite 54.7 points

Italian services activity contracted to start the new year, amid fresh COVID-19 restrictions related to the omicron variant. Overall, business activity also ground to a halt, as new business declined for the first time since April last year, while business confidence fell to a 12-month low. Elsewhere, inflation pressures remain severe even though cost pressures have eased a little since the November peak. Markit notes that:

“Italy’s service sector saw a rocky start to 2022, as fresh restrictions to curb the spread of the Omicron variant weighed on the performance of the sector. Output declined for the first time since last April, amid a reduction in new work, with foreign demand contracting at a particularly steep pace.”

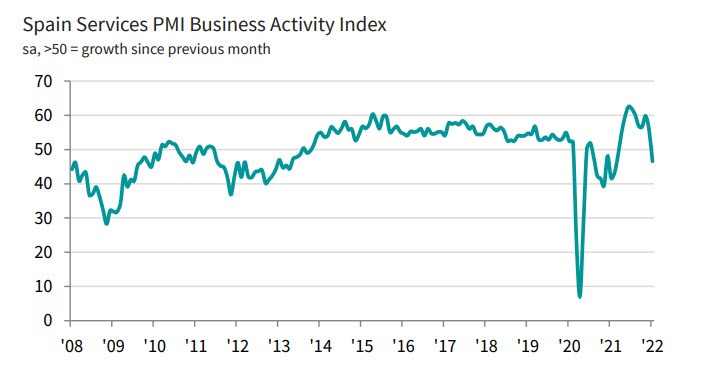

Spanish Services PMI Report January 2022

- Spain, January services PMI 46.6 points vs 55.8 prior

- December services were 55.8 points

There isn’t anything major to watch in terms of policy decisions today, so it will all boil down to the language and the communication. The most important thing is arguably the ECB’s outlook on inflation. In that regard, I expect the statement and Lagarde to reaffirm that they still see inflation pressures abating and easing in the latter stages of the year.

Yes, the can has been kicked down the road. But that’s exactly what they will keep doing for as long as they can get away with it. Besides that, I would expect the statement and any mention of rate hikes to be maintained. If anything, Lagarde will continue to play down rate hikes this year, just so it corresponds with the central bank’s take on inflation.

Where does that leave us?

There is a major discrepancy at the moment, in terms of what the ECB is saying, and what the market is pricing in for rates. The OIS market is pricing in nearly three rate hikes by the ECB by the end of the year, and in all likelihood, we might not even see one.

As such, any pushback on rate expectations today is likely to pose a downside risk for the Euro and bond yields in the region. Keep that in mind when trying to make sense of Lagarde’s remarks later in the day.