GBP/USD Heading for 1.30, Despite the BOE Already Having Hiked Rates Twice

The GBP started turning bearish in summer last year, as the USD started to turn bullish after hawkish FED comments, due to surging inflation, but in recent weeks, the decline has picked up pace. The Bank of England (BOE) has increased interest rates twice so far, from a base of 0.10%, but that hasn’t helped the GBP much.

The recent events in Ukraine have been weighing on the GBP and the Euro, but the Euro has recuperated somewhat in recent days, ahead of the ECB meeting. The Euro gained on prospects of the ECB starting to hike rates, which will probably happen in Q3, after they stop bond purchasing, while the BOE has already started hiking rates, yet the GBP is declining against both the Euro and the USD.

GBP/USD Daily Chart – Selling has Accelerated Again

Retraces have been quite weak in the last few weeks

Retraces have been quite weak in the last few weeks

In the last few months, we were seeing a consolidation in GBP/USD after the decline earlier last year, but since the last week of February, the bearish momentum has picked up again, as geopolitical tensions increase.

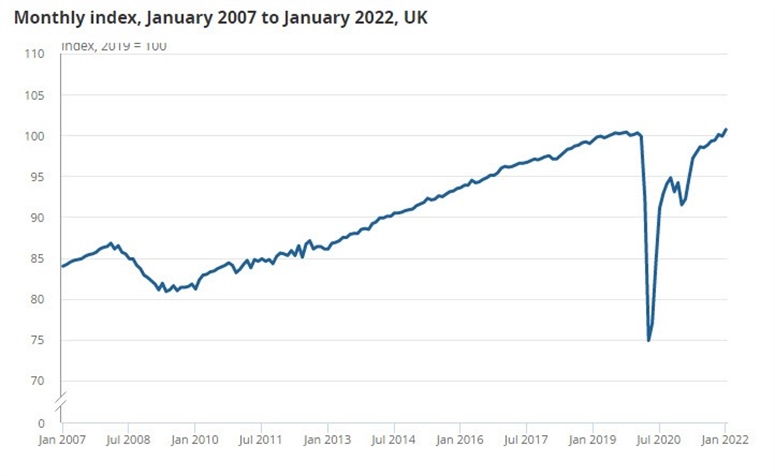

UK January GDP report

- January monthly GDP +0.8% vs +0.2% expected

- February MoM GDP -0.2%

That’s a decent beat on expectations, as the UK economy bounces back after the omicron drag in December. All sectors grew in the month of January, with services up by 0.8%, production up by 0.7% and construction up by 1.1%. Compared to pre-pandemic levels i.e. February 2020, GDP is now 0.8% higher.

Retraces have been quite weak in the last few weeks

Retraces have been quite weak in the last few weeks