Buying EUR/GBP As GBP Remains Under Pressure

The GBP has turned out to be one of the most bearish pairs in the last several weeks, sending EUR/GBP higher. GBP/USD opened with a gap lower last night and is keeping below 1.1500 on the day, trading at fresh lows since the early days of the pandemic in March 2020. The news of Russia cutting gas flows to Europe is also biting at the UK as energy concerns continue to grow amid soaring electricity prices. Russia is blaming the EU for that, while the UK is trying to pick up a prime minister, adding further to GBP worries.

Considering that both central banks (Fed and BOE) already gave a formal message that we are in the second half of the tightening cycle, the trade for cable is very much a case of who folds first. The Fed or the BOE? In this instance, it looks very much like the latter. Regarding the ECB, they just started raising rates and are picking up the pace, expected to deliver a 75 bps rate hike this week.

EUR/GBP H4 Chart – Will the 20 SMA Hold As Support?

EUR/GBP gained nearly 300 pips last week as the GBP continued to decline, while the Euro remained more stable. Today we are seeing a slight retreat on the H4 chart, which looks like a good opportunity to buy if the 20 SMA (gray) holds on the H4 chart. The stochastic indicator looks almost oversold while the Euro didn’t move much after the services and investor confidence reports, while the UK services report was released lower, closer to contraction.

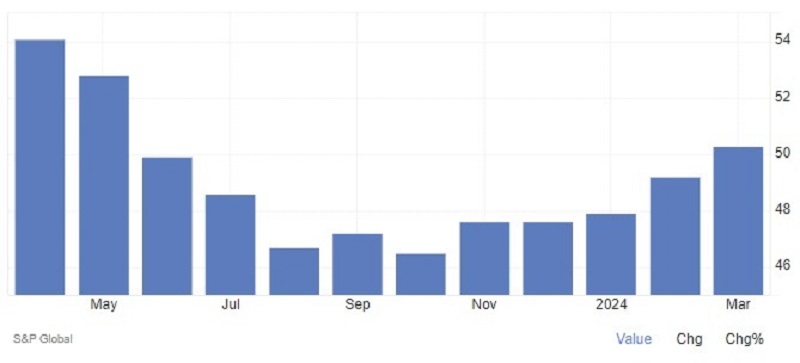

UK August Services by S&P Global – 5 September 2022

- August final services PMI 50.9 vs 52.5 prelim

- Composite PMI 49.6 vs 50.9 prelim

The revisions see the PMI data suggests that the UK economy has slipped into contraction in August with services activity crawling towards a stagnation. This is the weakest run of activity in 18 months as cost pressures remain elevated as businesses remain extremely downbeat about the outlook over the next year. S&P Global notes that:

“UK private sector business activity fell for the first time in a year-and-a-half in August as an increasingly severe downturn in manufacturing was accompanied by a nearstalling of the vast services sector. Demand for consumer-facing services such as restaurants, hotels, travel and other recreational activities is collapsing under the weight of the cost-of-living crisis, with demand for business services also coming under pressure amid concerns over rising costs and the darkening economic outlook. Financial services firms are meanwhile reporting subdued trading amid the recent hikes in interest rates, adding to an increasingly broad-based malaise across the economy.”