Trying to Be Careful With USD/JPY Longs, As BOJ Switches to Smaller, Frequent JPY Buying

Yesterday we saw a decent decline in the USD, led by USD/JPY which fell around 250 pips from top to bottom. It seemed as if this could be another intervention by the Ministry of Finance of Japan, since we heard rumours that they would opt for smaller and more frequent interventions. Although, the USD declined against all major currencies so, the intervention is not certain and Japanese officials didn’t confirm it. Nonetheless, it surely comes as some relief to Japanese officials.

Besides intervention, there wasn’t anything too important for the strong shift in markets that took place at the US open. There was some poor housing data and later, weak consumer confidence numbers, and a soft Richmond FED that followed. The bad-news-is-good news for risk assets is a theme in financial markets now, but that doesn’t explain the quick crash.

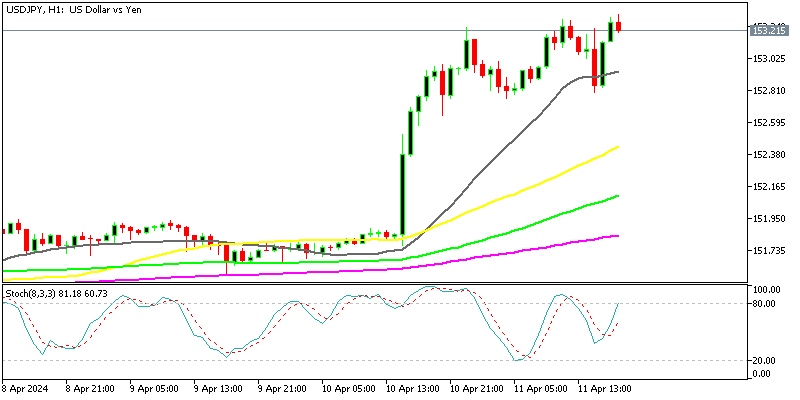

USD/JPY H1 Chart – Are MAs Turning Into Resistance?

Will buyers come back and resume the uptrend?

Reuters posted the following comments, which suggest that the Bank of Japan won’t confirm actions anymore, so that might have as well been the case. Anyway, we should be more careful with USD/JPY longs now after getting caught up during that crash on the wrong side.

This via Reuters, on the current neither confirm nor deny policy out of Japan:

- Japan has recently switched tack in how it conducts currency intervention. Rather than confirm action as in the past, Japan’s Ministry of Finance and the Bank of Japan have left the market guessing as to whether or not it intervened on a particular occasion.

- Granted, reports of the size of transactions on Friday and Monday, and moves in USD/JPY, leave no doubt in the minds of most that intervention actually took place. That said, this new strategy leaves open the possibility of smaller, perhaps more frequent interventions, and could keep market participants cautious for longer.

- Banks, which operate on behalf of Japanese authorities during interventions, are likely to remain mum on whether they were used for fear of being blacklisted by the BoJ. Monday saw especially good USD sales by one major Japanese mega-bank. Friday may have seen all three of Japan’s major banks in action given the reported scope of the intervention.