Forex Signals Brief for November 17: Can Philly Fed Manufacturing Turn the USD Around?

Yesterday’s Market Wrap

Yesterday the USD started the day on the retreat, after the softer producer inflation PPI report on Tuesday, which improved the market sentiment further, with traders expecting the FED to slow down rate hikes. But, US retail sales showed a 1.3% jump in October, which is good news for the USD, as it gives the FED one more reason to remain hawkish, so the USD took advantage of that while risk assets such as stock markets retreated lower.

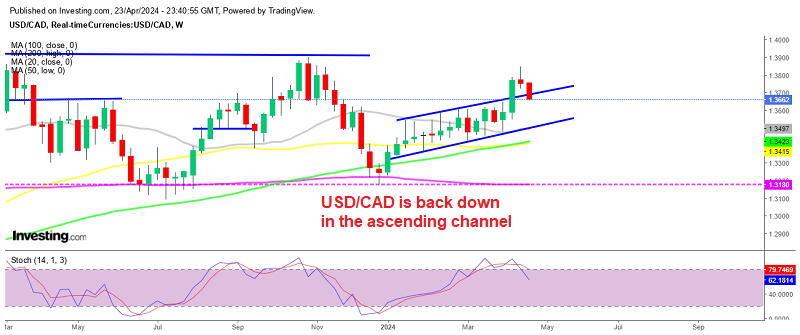

Before that though, the consumer inflation report from the UK beat expectations as the headline CPI number jumped to 11.1% in October from 10.1% in the previous month. WTI Oil posted a $3 decline despite the 440k barrel buildup in US EIA crude inventories, which was way smaller than the 5.4 million expected. So, USD/CAD had two reasons to rally higher and it gained around 100 pips.

Today’s Market Expectations

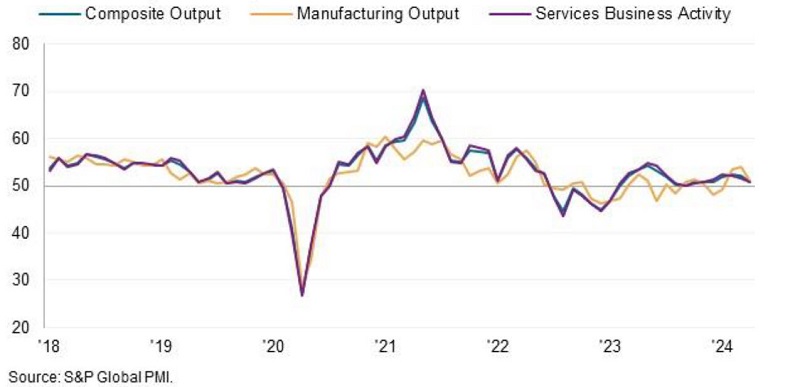

Today started with the employment report from Australia in early in the Asian session, after yesterday’s positive wage price index. In a while, the final Eurozone CPI inflation report will be released with the headline and core figures expected to remain unchanged at 10.7% and 5.0% respectively. In the US session, the Philly Fed Manufacturing Index will be released and it might give the USD another boost if it impresses after yesterday’s jump in retail sales, while in between the UK Autumn Forecast Statement will be released.

Forex Signals Update

Yesterday the volatility declined as traders are uncertain about where to go next after a strong retreat in the USD in the last two weeks. We decided to open three trading signals, two forex signals, and a Gold signal after the retreat post retail sales numbers.

Buying the Retreat in EUR/USD

EUR/USD has come back from the abyss where it fell last month, at around 0.95 and has gained nearly 10 cents since then, as the USD goes through a retreating period. So, the trend has been bullish for this pair and moving averages have been doing a good job as support on the H1 chart and yesterday we decided to open a buy EUR/USD signal after the retreat to the 50 SMA (yellow) which was acting as support.

EUR/USD – H1 chart

Buying GOLD at the 20 SMA

Gold turned bullish early this month and the 20 SMA (gray) has turned into support on the H4 chart. We have been using the 50 SMA on the H1 chart to buy retreats in Gold, but yesterday we decided to open a buy Gold signal at the 20 SMA after the retreat following the US retail sales.

XAU/USD – H4 chart

Cryptocurrency Update

Cryptocurrencies attempted to turn bullish in October but it ended with a crash as the FTX exchange was forced to sell off to Binance, with FTX’s token FTT falling below $2. Since then buyers haven’t got it together, but the selling has stopped and crypto coins are trading in a range again.

MAs Keeping BITCOIN Down Again

Bitcoin crashed lower early last week as it fell to around $15,600 from $22,000, after having traded in a range around $20,000 for more than two months. The 20 SMA (gray) turned into resistance on the H4 chart and was pushing the price lower, but yesterday buyers pushed BTC above that moving average. Although the 50 SMA (yellow) turned into resistance, which gave BTC another push lower.

BTC/USD – H4 chart

ETHEREUM Testing the 200 SMA

Ethereum pushed above $1,660 early last week before the FTX bankruptcy sent ETH crashing lower and despite attempts to turn bullish, sellers still remain in control, but buyers are slowly regrouping. They have tested the 200 SMA (purple) on the H1 chart, but it provided resistance yesterday.