USD Advances Higher As Positive Data Keeps FED Hawkish

The USD is gaining some momentum as the economic data from the US remains more upbeat than markets were expecting

The USD was surging higher as the FED was hiking interest rates very fast last year. But, they softened the rhetoric eventually after several 75 basis points (bps) hikes in a row and slowed down to 50 bps in the last meeting. As a result, the USD turned bearish, risk sentiment improved and everything else surged higher.

But, the economic data from the US has been showing some sort of resilience, at least more than what markets were expecting, such as a hard landing which means deep recession. As a result, traders were confused and in the last 2-3 weeks we have seen markets bounce up and down in uncertainty, especially after the December 50 bps rate hike by the FED, the ECB etc.

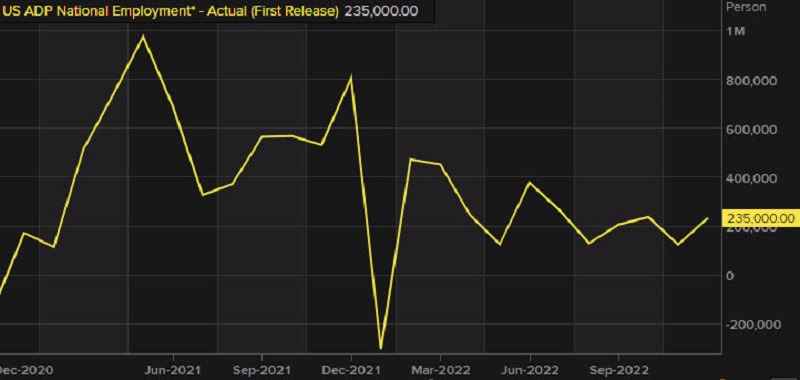

US December Employment Data from ADP

- December ADP employment +235K vs +150K expected

- October ADP employment was +127K (lowest since Jan 2021)

- Forecasts ranged from +100K to +220K

- Annual pay 7.3% vs +7.6% prior

- Goods-producing sector added+22K jobs vs -86K prior

- Service-providing jobs added +213K vs +213K prior

“The labor market is strong but fragmented, with hiring varying sharply by industry and establishment size,” said Nela Richardson, chief economist, ADP. “Business segments that hired aggressively in the first half of 2022 have slowed hiring and in some cases cut jobs in the last month of the year. Construction and leisure/hospitality hiring was particularly strong while trade/transportation/utilities and natural resources/mining were soft.

Gold H4 Chart – Can the 50 SMA Hold the Retreat?

XAU/USD is oversold on the H4 timeframe

Today’s ADP employment report came in much stronger than expected, showing 235K new jobs, while expectations were for a 150K reading. The USD was gaining some momentum earlier today and this report helped it further. Gold fell below $1,830, but it seems like the 50 SMA (yellow) is stopping the decline. We decided to open another buy Gold signal today.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account