EUR/CHF Makes An Important Break Above Parity, AS ECB Keep Rate Hiking Rhetoric

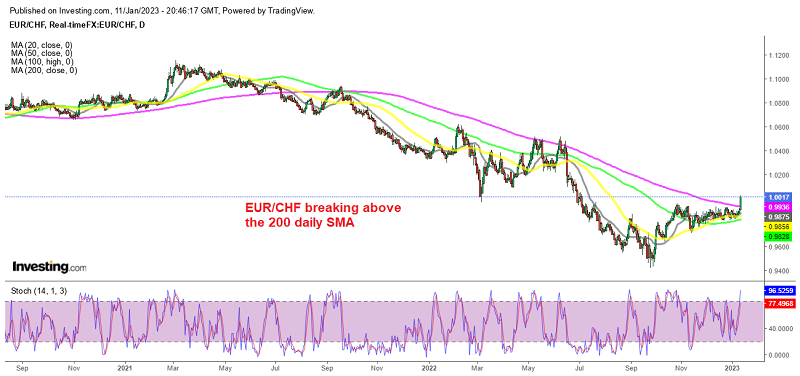

USD/CHF turned bearish in November last year, as the USD retreat picked up momentum, while EUR/CHF has been bearish since early 2021. During this time, moving averages and particularly the 200 SMA (purple) has been doing a great job in providing resistance for this pair, as seen from the daily chart above.

This pair hasn’t made a clear break above this moving average since July 2021, but yesterday we finally saw a decisive break. The CHF was under pressure across the board, with Swiss 10-year yields falling by 15 bps to 1.25%. But the decline in the CHF is more visible against the Euro, after the price shot above the 200 moving average and above parity.

The sentiment has improved and the market is feeling increasingly good about the outlook for Europe as the good weather continues. TTF energy prices went down another 7% yesterday and the economic data has shown some resilience. Italian retail sales posted a decent jump of 4.4% for November while Tuesday’s French industrial production numbers beat expectations.

So, technically the break above parity and particularly the 200 daily SMA is a great sign for buyers. It comes after months of consolidation with little near-term resistance. We saw a 100 pips surge in USD/CHF as well yesterday which triggered the SL of our sell signal here. But the 200 SMA stopped the surge, so we are thinking about opening another sell signal in this pair.

USD/CHF H4 Chart – The 200 SMA Acting As Resistance