AUD/USD Looking Bearish After the RBA

AUD/USD has made a strong bearish reversal despite increasing inflation in Australia, but sellers are facing the 50 daily SMA now

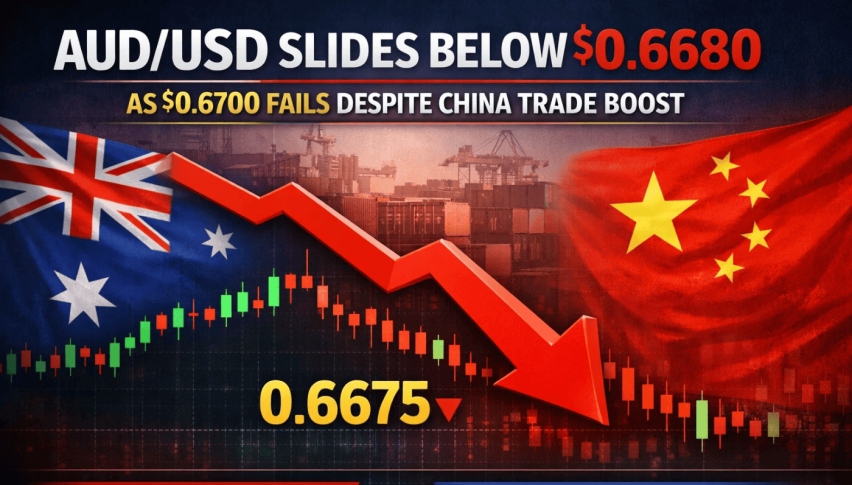

AUD/USD made quite a bullish reversal in October at 0.6170s and climbed 10 cents higher, breaking all moving averages on the daily chart, as the USD kept declining. But, the sentiment has turned negative since last Friday and we have seen a strong bearish reversal in this pair. The price has declined by around 300 pips, and sellers are now facing the 50 SMA (yellow) on the daily chart, after breaking the 20 SMA (gray).

This pair fell for the third day yesterday amid a persistent US Dollar strength. Although the price bottomed at 0.6854 where the 50 SMA (yellow) was waiting. Retail Sales, posted a big 3.9% in Q4 while the inflation report showed that the University of Melbourne inflation estimate rose by 0.9% MoM and by 0.5% YoY to 6.4% in January from 5.9% in December.

This came a day before the Reserve Bank of Australia (RBA) meeting, which was widely anticipated to tighten its monetary policy by 25 basis points (bps) for the fourth consecutive meeting. Although, with inflation moving higher, there was a small chance that the RBA could have gone for a 50 bps hike.

AUD/USD Daily Chart – The 50 SMA Stopped the Decline Yesterday

Is the retreat over or is the trend changing?

RBA Cash Rate Decision and Statement

- RBA raises the cash rate by +25bp to 3.35%, as expected

- Inflation is expected to decline this year due to both global factors and slower growth in domestic demand.

- Board expects further increases in interest rates

- Board resolute in its determination to return inflation to target

- The central forecast is for CPI inflation to decline to 4¾ per cent this year and to around 3 per cent by mid-2025.

- GDP growth expected to slow to around 1½ per cent over 2023 and 2024.

- Path to achieving a soft landing remains a narrow one

- The labour market remains very tight.

- Central forecast is for the unemployment rate to increase to 3¾ per cent by the end of this year and 4½ per cent by mid-2025.

- Wages growth is continuing to pick up from the low rates of recent years and a further pick-up is expected due to the tight labour market and higher inflation

- Some households have substantial savings buffers, but others are experiencing a painful squeeze on budgets

- Household balance sheets are also being affected by the decline in housing prices

- Uncertainties mean that there are a range of potential scenarios for the Australian economy

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account