EUR/USD Exchange Rate Stable Amidst US Banking Concerns and Upcoming Federal Reserve Meeting

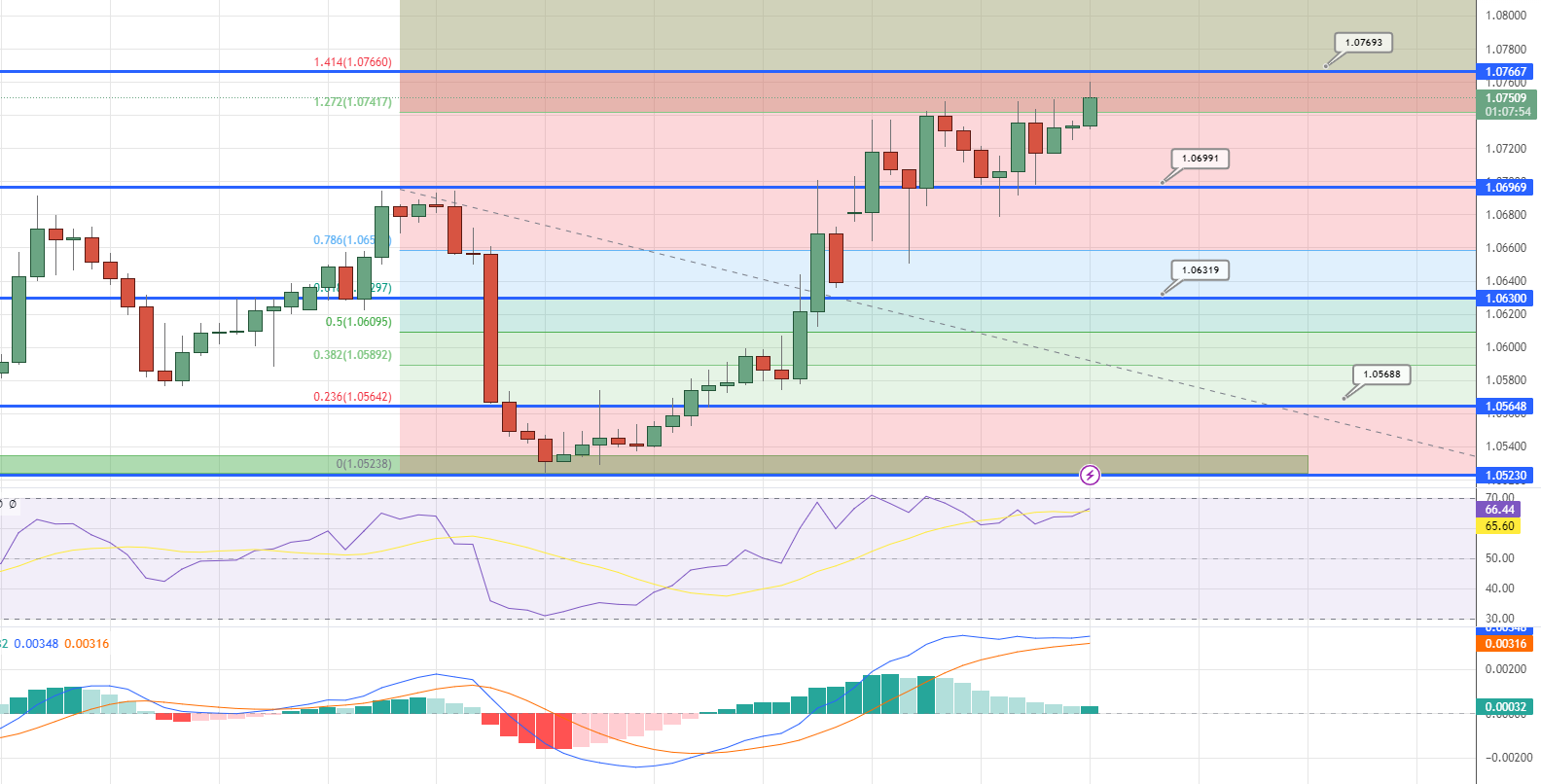

The EUR/USD exchange rate has remained steady in recent times, hovering in a narrow range between 1.0725 and 1.0742.

The EUR/USD exchange rate has remained steady in recent times, hovering in a narrow range between 1.0725 and 1.0742. The banking sector experienced gains overnight, as did bonds and interest rate futures, despite some recent failures among US financial institutions. As a result, fears of the crisis spreading throughout the US banking system have eased, leading to a strengthening of the US dollar.

Investors are proceeding with caution in anticipation of next week’s Federal Open Market Committee meeting. In February, the US Consumer Price Index (CPI) rose by 0.4%, following a 6.4% rise in January. Although the 12-month CPI gain of 6.0% was slower than January’s 6.4%, it remained above the 2% target set by the Federal Reserve. The US dollar gained demand in response, reaching a session high in the US, but it has since retreated, and futures markets are predicting a rate cut from the Fed before the end of the year.

There are mixed opinions on whether the Fed will initiate a rate hike next week in response to continued high inflation. Following the failures of Silicon Valley Bank and Signature Bank, investors are now expecting a terminal rate of 4.45% for December, down from over 5% the previous week. Fed funds futures pricing also indicates a shift in expectations for the upcoming FOMC meeting. Nonetheless, the CME’s Fed Watch Tool indicates a 28.4% likelihood that the Fed will remain dovish at the conclusion of its two-day policy meeting on March 22, a significant decrease from the day before the CPI data release.

Moving forward, the European Central Bank will play a crucial role. TD Securities predicts a 50 basis point rate hike and the abandonment of forward guidance beyond the next meeting, shifting focus to data dependence. Lagarde is expected to maintain a 50 basis point hike for the May meeting when she addresses the press. Inflation estimates are expected to be lower than previously thought, although core inflation and growth are expected to strengthen.

Moving forward, the European Central Bank will play a crucial role. TD Securities predicts a 50 basis point rate hike and the abandonment of forward guidance beyond the next meeting, shifting focus to data dependence. Lagarde is expected to maintain a 50 basis point hike for the May meeting when she addresses the press. Inflation estimates are expected to be lower than previously thought, although core inflation and growth are expected to strengthen.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account