USD Resumes Decline After Softer JOLTS Jobs Report

The JOLTS job openings report missed expectations, falling below 10 million in March, which is pushing the USD down again

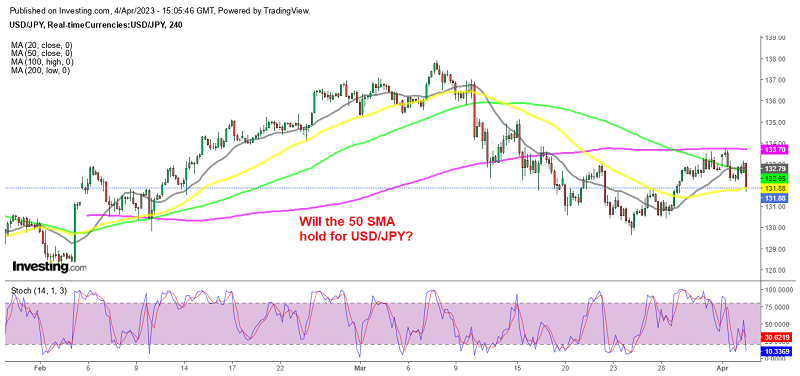

The USD has resumed the decline today after turning bearish again yesterday and it’s losing ground against all other currencies. The decline in USD/JPY is an example of how quickly it has fallen, as this pair has lost around 135 pips to 131.75, which is the lowest it has been in a week. Gold has also surged higher, moving decisively above $2,000, and it seems like this time buyers will hold the price above there after several failures to do so last month.

The reason for this weakness in the USD is the release of the JOLTS job openings report, which showed a decline in from 10.82 million in February (although this was later revised to 10.56 million) to 9.931 million in March. While job openings are still relatively high, the pace of the decline is what has caused the market to react negatively.

JOLTs Job Openings Report

- Prior month 10.824M (est. 10.5M) revised to 10.563M

- Job Openings for February 2023 moves to 9.931M vs 10.4M estimate and 10.563M last month

- Quits rate 2.6% vs 2.5% last month. Total quits came in at 4.024 million versus 3.878 million was more than

- Hires 4.0% vs 4.1% last month. Total hires came in at 6.163 million versus 6.327 million last month

- Separations 3.7% of versus 3.8% last month. Total separations came in at 5.82 million versus 5.90 million last month

The JOLTS report, a monthly report by the US Bureau of Labor Statistics, provides important data on job openings, hires, and separations in the United States. However, there are concerns about the reliability of this data due to changes in hiring practices by companies. Instead of following the traditional protocol of advertising a job when it becomes available and then filling it, many companies are now “always hiring” and leaving job postings up even when they are not actively seeking to fill a position.

This can lead to job seekers spamming companies and job sites, as well as the creation of “ghost jobs” where companies post job advertisements they have no intention of filling in order to create the impression that the company is growing or to reassure overworked employees that help is on the way. Despite these concerns, the JOLTS report remains a valuable tool for assessing the overall health of the US economy.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account