USD/CAD Grinds Higher Amidst Downbeat Oil Price and Risk-Off Mood

Early on Thursday morning in Europe, the [[USD/CAD]] pair approaches the significant 1.3500 level, maintaining gains from the previous day and reaching a one-week peak.

Early on Thursday morning in Europe, the USD/CAD pair approaches the significant 1.3500 level, maintaining gains from the previous day and reaching a one-week peak. The Loonie pair is supported by the decline in oil prices and the market’s shift towards risk aversion, despite concerns over a full-blown conflict between China and the West and weakening consumer spending in the US impacting market sentiment.

The US Dollar Index also benefits from the risk-off atmosphere, with New York Fed President John Williams endorsing a 0.25% interest rate increase in May to counter excessive inflation and restore price stability. Market participants are now placing higher bets on the US central bank’s 0.25% rate hike in May, while reducing the likelihood of a rate cut in 2023.

Canadian data, including Housing Starts, Industrial Product Price, and Raw Material Price, have been disappointing, but optimistic remarks in the Fed Beige Book provide further support for the Loonie pair. Comments from Bank of Canada Governor Tiff Macklem and Deputy Governor Carolyn Rogers will be critical, even though both are expected to justify the recent pause in domestic rate hikes, which could boost the Loonie pair’s value.

Additionally, secondary US data such as Weekly Initial Jobless Claims, Philadelphia Fed Manufacturing Survey, and Existing Home Sales will be under scrutiny. Above all, risk factors and bond yields will play a significant role in shaping immediate USD/CAD movements, particularly as the S&P 500 Futures report the first daily loss in four days at around 4,168 and the US 10-year and two-year Treasury bond yields hover near 3.60% and 4.25% respectively, following the previous day’s monthly highs.

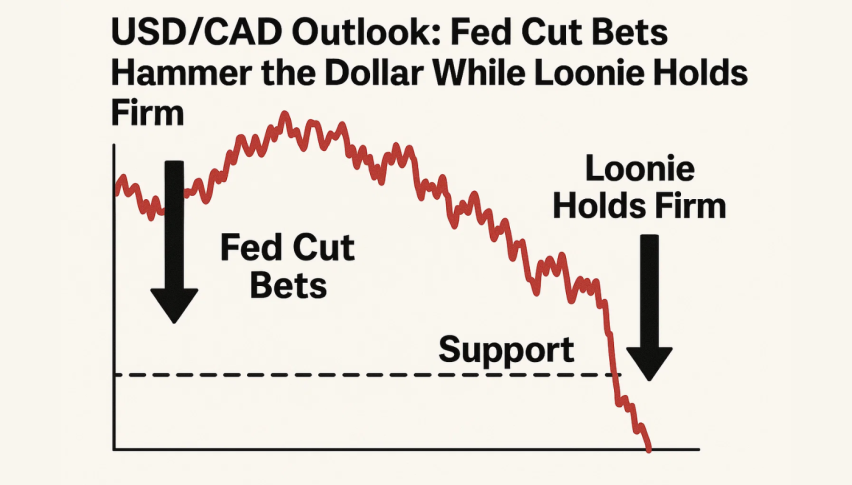

USD/CAD Technical Outlook

The USD/CAD pair has successfully broken through the resistance of the bearish channel, paving the way for it to reach our primary anticipated positive target at 1.3500. This reinforces the expectation of further gains in the coming sessions, with a breach of the mentioned level potentially extending the bullish trend towards 1.3590.

The 50-day exponential moving average (EMA50) underpins the price, bolstering the chances of additional gains in the future sessions. However, it is important to note that a break below 1.3410 would halt the current bullish momentum and push the price to test the critical support at 1.3350 before the next trend can be clearly determined.

For today, the expected trading range is between 1.3400 support and 1.3560 resistance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account