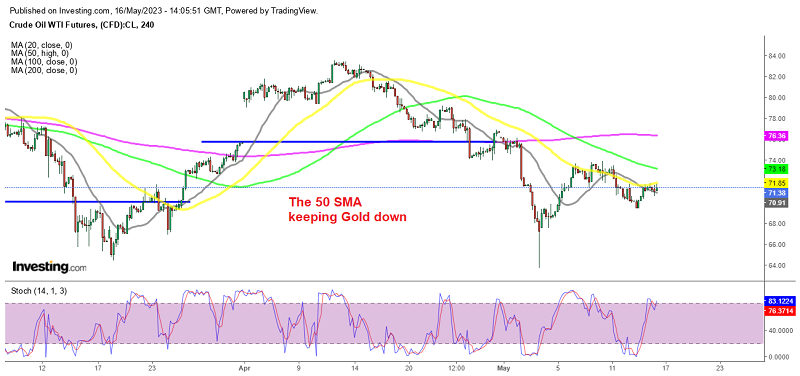

Remaining Short on Oil As Global Economy Keeps Slowing

Crude Oil retraced higher yesterday, but the main trend remains bearish as the global economy slows, so we opened a sell Oil signal

Crude Oil made a strong bullish move at the beginning of April, opening with a massive $5 gap higher after OPEC deiced to cut production. But, it failed to keep the bullish momentum as the slowdown in the global economy picks up pace, which is keeping the sentiment soft for risk assets.

US WTI turned bearish by the middle of April and in the first week of May we saw a tumble lower as the banking problems in the US returned, which sent risk assets crashing lower. US crude fell toward $63 as inventories also posted another big buildup. The price formed a big doji candlestick on the daily chart, which is a strong bullish signal and we saw a bullish move in the following days.

But, buyers gave up below moving averages and in the second half of last week sellers returned, as risk sentiment turned negative on softer economic data from all over the globe and the absence of comments from the FED to start cutting interest rates later this year.

But, crude Oil was steady yesterday at the start of the new week, after retreating in the last few sessions of last week, with the US Dollar finding firmer footing and the market taking some positive news from US data. Jobless claims were above estimates at 264k for last week rather than the 245k anticipated, but PPI came in at 2.3%, instead of the 2.5% expected and 2.7% previously.

The jobs data points toward an easing in the tight labour market while the PPI figures led to hopes that consumer price pressures might be softening down the track. Both economic data points appeared to reaffirm the view that the Federal Reserve will pause its hiking cycle at the next Federal Open Market Committee (FOMC) meeting in June. The futures and overnight index swap (OIS) markets are pricing in a Fed cut for September despite comments overnight from Minneapolis Federal Reserve President Neel Kashkari overnight. He said that while CPI has been coming down, it remains too high. We opened a sell Oil signal yesterday and are keeping it open after the rejection at the 100 SMA on the H1 chart yesterday.

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account