EUR/USD Analysis: Amidst Mixed Concerns, Euro Clings to Gains Around 1.0880

EUR/USD holds onto marginal gains, hovering around 1.0880, as it defends a week-start rebound from its lowest point in six weeks.

[[EUR/USD]] holds onto marginal gains, hovering around 1.0880, as it defends a week-start rebound from its lowest point in six weeks. This Euro pair’s recent recovery may be attributed to the consolidation of the previous five-week downtrend, alongside positioning ahead of the August month’s Purchasing Managers Indexes (PMIs) and the notable Jackson Hole Symposium hosted by the Kansas Fed for central bankers.

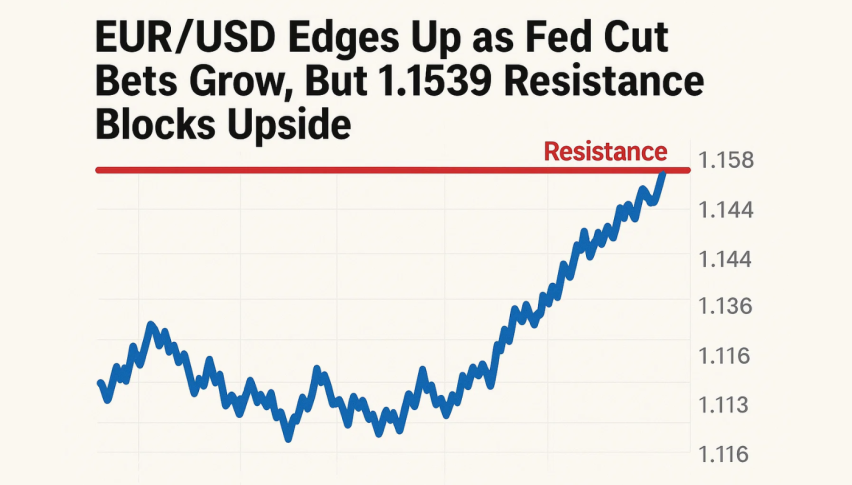

From a technical standpoint, Friday’s Doji candlestick formation, coupled with an RSI (14) line that is nearing oversold conditions, prompts a corrective bounce in the EUR/USD price.

However, a convergence of the 100-day Exponential Moving Average (EMA) and a descending resistance line originating from July 19 pinpoint the 1.0900 level as a formidable barrier for Euro buyers.

Following this, a descending trend line established over the past month, situated around 1.0980, acts as the ultimate defense for the EUR/USD bears.

In contrast, a horizontal zone encompassing various levels since April 10, with 1.0840 being the latest, curbs immediate downside for the EUR/USD pair.

In contrast, a horizontal zone encompassing various levels since April 10, with 1.0840 being the latest, curbs immediate downside for the EUR/USD pair.

A daily close below 1.0840 should not be immediately interpreted as an open invitation for Euro bears, as the 200-day EMA and an ascending trend line from mid-March, approximately at 1.0800, might challenge further downside movement.

In essence, the EUR/USD pair remains under the bearish lens despite its recent rebound. Nevertheless, the scope for downside movement seems to be constrained.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account